mcm daily market update 27.Oct.22

Main trend: up

ST trend: neutral

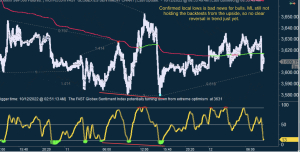

Yesterday the market continued to push higher after holding ML once again. Bulls almost touched 3900 ES, before bears finally emerged and we had the 1st large reversal lower in quite a while. Price ended up near ML again.

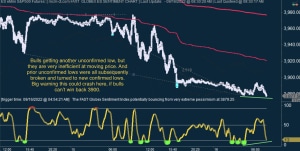

The o/n was neutral, as bulls managed to win back ML initially, but gave it up again. So far though they are still avoiding a real ML breakdown, so the immediate trend is up for grabs. If ML is lost on a sustained basis, then macro-ML is the next target on the downside. Losing macro-ML would be very problematic for bulls as it would signal the main trend is shifting as well.

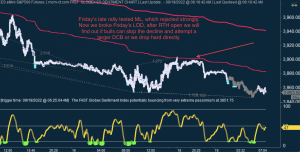

In the bigger picture, it looks like the impulsive move off 3650 finished yesterday and we started a larger degree correction. Whether the entire move off 3500 finished is debatable since the waves are overlapping and some of them also look corrective, which would point to either a complex correction (WXY type) or at least one more 4-5 unwind to the upside needed still. So one step at a time continues to be the right approach. For now it looks like bears finally started a larger correction so once this 1st push lower is done, a DCB (dead cat bounce) and then another push lower should be the next path. After that, we'll just have to see if it will turn into a larger impulsive move or not. 3750-3770 looks like the inflection area bears could hit on this pullback.