mcm daily market update 12.Oct.22

Main trend: down

ST Trend: neutral

Yesterday the market dropped to new lows, before staging a face ripping rally until lunch time. After that the BOE crushed the bulls' hopes and the mkt lost ALL its gains to make a new low on ES and basically made a double bottom on SPX before bouncing a bit into the close.

The o/n was decently bull friendly as they continued the late day bounce and even managed to peak above ML, but the PPI came in hotter than expected, so bulls lost what was building as a gap up and now indicate a flat open. The RTH open will be important, as will reaction off it. If bulls can win ML again and hold above it, then they may have hopes at a larger bounce into a macro-ML back-test. On the other side, if bears take control early on, this can slice the recent lows to make new lows again. Therefore for today ML is key on the upside, while yesterday's LOD is important on the downside.

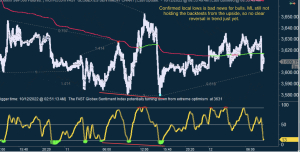

In the big picture, this chopping around is typical of a compressed spring before the explosion, setting up after CPI release tomorrow. Wave wise the lows do not look stable or "clean" and I would expect them to be taken out, if not today, then tomorrow after CPI. Because we overlapped the end of Sept lows, the entire move off 4300 now looks like an impulse, however the last wave (5) is still too short. Which means more downside is likely needed before the structure can complete. The last wave started at 3800, so that's the KO lvl for bears. If bulls can somehow overlap that lvl before heading lower from here, then they would have dodged a bullet. Given how the structure looks at the recent lows, I put the odds of bulls winning 3800 before we are heading below 3500 at slim to none. The GSIs also lost the clear unconfirmed lows with the subsequent lows as both FGSI and IGSI have confirmed local lows. That's not ideal since it would indicate that the initial unconfirmed lows were broken as momentum was too strong and the bounce was overwhelmed.