NOTE

The daily market updates will be provided via the chat room, please access it at https://mcm-ct.com/conversation-room-ticktools-livestream/ to get pre-market updates as well as live comments during RTH session.

The daily market updates will be provided via the chat room, please access it at https://mcm-ct.com/conversation-room-ticktools-livestream/ to get pre-market updates as well as live comments during RTH session.

Main trend: neutral

ST trend: down

The market rallied relentlessly in the last weeks, with every drop attempt being bought aggressively. Also of note is that the market saw up squeezes in the last 3 consecutive days. So definitely the market was overextended in the near term. Friday saw bulls pushing beyond the 4100 ES mark, but they gave it up in the last 30m when a aggressive 20 point flush occurred.

The bigger problem for bulls is that that decline seems to have been only the beginning of what looks like a deeper correction. Sunday and Monday saw continued weakness and we dropped another 40 points from there. Bulls lost ML and price is now directly testing macro-ML. If this line is lost, then trend ML is the last defense for the up trend. Bulls could still repair some of this damage before RTH open, but so far the price action is definitely bearish. Each tiny bounce is pounced on and sold to new lows. Danny has been capping price like a champ.

In terms of the larger picture, it is possible the market is heading back to 3700 area, before heading higher above 4100. It all depends on whether bulls can defend macro-ML and trend ML here. Both are at huge technical levels and if they are lost for more than a head-fake, then that 3700 target would start to increase in odds.

Main trend: down

ST trend: up

After 5 straight red days, and a whooping 300 points loss, SPX finally put in a green candle yesterday. Not only that, but bulls managed to bounce off unconfirmed GSIs on all time frames and won back ML.

The o/n saw a shy continuation of the bounce as bulls managed to hold ML on all back-tests and continued to put in higher highs. Now ML is under attack again, it is key that bulls continue to hold here.

In the big picture view, bulls managed yesterday to also get out of the crash channel which started from the lower high vs 4100. We saw non-stop violent selling inside that channel and bulls are finally out. They need today to be a continuation day to stick the breakout (both over ML and out of that crash channel). The next BIG resistance above is at macro-ML near 3890 ES and then at trend-ML near 3950. These lines align and converge on large technical levels so they are very important. On SPX side 3870-3900 area is going to be tough to overcome from the bull side. If they can 3950 is next... above that is starting to get iffy for the bear case. So keep an eye on that area as we will likely know if this is just a DCB or bulls have bigger intentions .

Main trend: down

ST trend: down

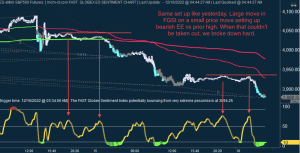

Yesterday I alerted the members in the mcm chatroom that if bulls were unable to defend the opening SE Xtick and at least try to fill the gap, the breakdown would point to 30-50 points lower and we could be in for a strong down trend day. 1st part proved to be conservative as open to LOD was 70 points, while the 2nd part was spot on. TTs provided nice opportunities to re-short or start a short for those who missed the initial breakdown with danny capping price all day and with several BEs which hit (and held). In such strong trend days best is to play the trend until it breaks, which only happened 1.5h before the close with a decently strong bounce. Danny is an amazing line for showing the immediate trend.

In the o/n we had the exact same set up which we had yesterday in the o/n and triggered the 1st short opp. FGSI bouncing hard on shallow price movement and setting up bearish EE above centerline. The inability of price to conquer the prior high triggered the sell and we sold off 40-50 points, just like yesterday. This sets up another large gap down (if holds until RTH open), and back to back runaway gaps can lead to crashes. That being said, I do not think the market can sustain 2 runaway gaps in an OPEX week. So I would expect MMs to change the tune and attempt to fill it rather than let it run like yesterday. The opening SE will help in identifying if we breakdown again and run or not.

In terms of the big picture, bulls are in big trouble here. They lost the trend (all MLs were broken and are now above price and red) and also the wave structure off the last 4100 high looked like nested bear waves which now confirmed with yesterday's runaway gap. Once they manage to stop the bleeding ,the shape of the bounce will tell us if we are going to revisit the Oct lows or not. In anycase it looks like a bigger retrace is now needed before potential new highs above 4100.

Main trend: down

ST trend: down

The market put in a high near 4100 last week before pulling back from there. 200DMA is also there plus several technical resistances, including the "bear market TL" coming from ATH, so no wonder that triggered a reaction. The bad news for bulls is that the highs were unconfirmed on all GSIs and price broke below all MLs as well, confirming the change of trend.

Yesterday we saw a clear down trend day with every pop being sold, while the o/n continued in the same manner. Yesterday's LOD is an important lvl on the downside, as we have bullish EE on FGSI vs that low. On the bull side, they need to hold that low and attempt to breakout above 400bar MA (1st step), then to challenge ML.

From a larger picture perspective, the rejection at 4100 looks ominous for bulls, especially coupled with the GSIs showing those highs as unconfirmed. On top of this, the decline off that lvl looks nested, meaning a series of 1-2 waves. If the market continues to drip lower, the drop is likely to accelerate soon. The bulls have one chance here to stop the bleeding and stop the decline as a rare double 3 correction (WXY). The 4020-4040 area is the very important area which bulls need to win back asap. No coincidence that both ML and macro-ML are in that area.

Main trend: up

ST trend: neutral

Markets finished last week undecided putting in an indecision doji, ending the week near the lvl where they started, with long tails both up and down. Friday was OPEX and the whipsaws didn't dissappoint, large gap up, that got sold hard, then LOD hit near mid day and push higher into the close to end at the infamous 3960 lvl.

The o/n was pretty indecisive, however price dripped lows and broke below ML and macro-ML. Bulls are not beat yet, as Friday's low wasn't broken, but the loss of ML and macro-ML is a warning. Those are the key levels going fwd. If bulls cannot win back ML and macro-ML, then that would mean bears are taking control and we have likely started a larger degree decline. If they do manage to breakout, then they have a shot at pushing this back higher.

In the big picture, things are at a cross roads here. There is at least a chance that last week's high marked the end of the entire move off 3500, which would mean a large retrace is due. Bulls still have some outs as the decline off that high is only 3 waves so far and we overlapped the low of the 1st wave. So if bulls can push here, they can "lock in" another 3 wave decline (which is corrective) and can extend this above the recent highs, potentially into the next resistance area near 4100. The problem is, if they cannot do that and the lows are broken, the most obvious bearish pattern would be a bear nest, which would mean an acceleration to the downside. From an EWT perspective Friday's high is important and then the 4000 lvl on the upside while 3922 SPX and then 3900 are key on the downside.

Main trend: up

ST trend: up

The market flushed yesterday in a pretty violent manner opening with a large 50+ points gap down, however bulls managed to defend the prior support area near 3900 and staged an impressive rally. The gap fill area provided some resistance for a late day drop, but bulls again managed to come back and in the last 30m almost got back to HOD.

The o/n continued what looked like a new found bullish leg as bulls easily took out the RTH HOD from yesterday, pulled back from there, but then made new highs. So for now bulls look like they are in control as they recovered ML and macro-ML easily. Those lines remain important and bulls will want to hold above in case of any pullback.

Big picture wise it looks like bulls have "one more wave" up looks like a 4th wave, with another push to recent highs near 4030 still needed to complete the move. It could, ofc, go higher, but once we have made a new high bulls will want to be careful as there would be enough waves in place for a complete move off 3700 and 3500. Given that we traveled more than 500 points, the coming same degree pullback is likely to be large.

Maine trend: up

ST Trend: up

The market continued the melt-up started after the CPI numbers. The rate of ascent slowed, but bulls still managed to clip 4k, before staging the 1st steep reversal yesterday, dropping 50 points in 2h. The drop also sliced below ML, but bulls quickly recovered it in the o/n.

The overall picture is bullish, as price is above all 3 MLs. However due to the quick 250 point rise, bulls are vulnerable to a larger pullback. ML is the 1st main trend support. If that fails, it would target macro-ML. More worrying for bulls is the fact that the recent highs were unconfirmed on all GSIs. And MGSI touched extreme optimism, then had an unconfirmed high. MGSI rarely touches extremes, so that is definitely a warning this rally is very overbought near term.

In terms of bigger picture, bulls rallied so much that now the question if this 1st leg of the bear market finished at the October lows comes into play. Especially DJIA managed to almost overlap its August high, which would hint to that. NQ is still a ways off that high, while SPX is in the middle, so it remains to be seen if these will make new lows, while DJIA makes a higher low and diverge... or if they manage to follow DJIA and continue the run up.

In terms of EWT, the huge gap up 'n run off the CPI numbers feels like a wave 3, so it does seem like we would need a pullback for wave 4, then another push higher into wave 5. Given that it's OPEX this week, this kind of back and forth would fit the MMs quite well to shake out both sides. 4000-4010 is significant resistance and if bulls manage to push through, they could go as high as 4100. We will know more about how likely that is once we see what shape the 4th will have and how price reacts once it retests the recent highs.

Main trend: neutral

ST trend: up

Things were looking pretty grim for bulls last week after a hawkish FED broke the up trend, price slicing below all MLs and some important TLs. On Thursday bulls managed to defend the 3700 SPX lvl and chopped in a 50 point range. Friday saw a surprising gap up, which was sold twice, but bulls managed to come back each time. Price rejected on Friday at macro-ML, but bulls managed to defend ML, albeit sloppy. So while bears had every reason to break lower, they couldn't, so it looks like they dropped the ball, bulls signaling that they are ready to take the lead again.

Sunday saw a gap down, but also that was bought and bulls managed to defend ML. Now bulls are trying to breakout from macro-ML too. These developments show that bulls are attempting to win back the ST trend.

In terms of the larger picture, EWT wise the situation is pretty complicated. We have what looks like a corrective 3 wave pattern off the 3500 lows, however the drop off the recent highs at 3910 also looks like only 3 waves so far. Given the strong bullish showing on Thursday-Friday it would seem that bulls are attempting to lock-in this 3 wave decline and turn that larger 3 wave bounce into an impulse. 3760 SPX area seems to be the key area to win/defend for both sides. Not surprisingly ML converged there in the o/n and was defended by the bulls. If bulls manage to defend this area, then 3800 is the next lvl above, followed by 3845 and 3895 which are 2 important EWT overlaps.

In conclusion, the immediate trend favors the bulls, as they defended ML and won back macro-ML. They need to hold above these 2 lines to continue the upside. Bears on the other hand would need to prove themeselves by breaking below them. Only if they manage to break back below ML will they be back in the lead.

Main trend: up

ST trend: up

After hitting a low near 3800 on Thursday, the market bulls managed to bounce hard on Friday pushing to new highs and touching that elusive 3900 area. Mkt finished at the highs on Friday, to end the week on a high note.

Sunday open saw a quick drop from there and we saw the usual ML back-test, as anticipated in the chat room on Friday. Text-book action so far. Now the important thing is what price will do next from this inflection zone. If ML holds, then bulls might get the chance to push one more leg higher. If ML fails, then bears might get a shot at macro-ML below (near 3840 area as of this moment). FGSI is showing bearish EE, as bulls are inefficient, so it could be a sign that bears might get a chance to look below ML.

In the big picture, we had that "at least one more" 4-5 unwind, so the question now becomes is the upside done or will they turn it into sth else. So far the move off 3500 low still looks like a correction. If bulls would manage to defend 3800 zone on any pullback and then push to new high above 3900, then it would start to look impulsive. So we are now at the inflection point of either an abc correction off 3500 OR an impulse. Worth mentioning is that even if this move will turn impulsive, a decent retrace either to 3800 area or 3750 below will be needed. So immedite term, it looks like bulls need to be a bit coutious and see how things shape up before committing too much on the long side.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, you cannot refuse them without impacting how our site functions. You can block or delete them by changing your browser settings and force blocking all cookies on this website.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Legal Privacy Statement