mcm daily market update 8.Apr.22

ST trend: up (with correction ongoing)

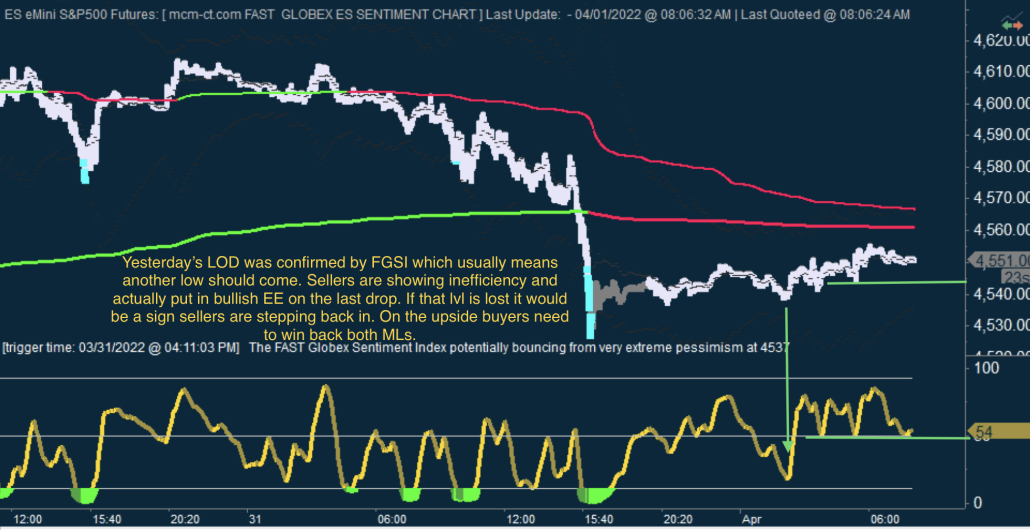

Yesterday we were noting that the ST trend was neutral as we were still in the prior day's range (from the FOMC minutes spike high and low) and having bearish and bullish EE vs those levels. Sustained breakout/down of those levels was needed to escape the range. Initially we saw a rejection at the upper level, then buyers lost ML and we went down all the way to test the lower end of the range. That held as well and after being marked as an unconfirmed low on both FGSI and IGSI, the buyers stepped in with authority and put in a larger bottom.

The o/n played out well for buyers. We had the usual sideways consolidation from the yesterday's RTH highs, but sellers couldn't even touch ML on the pullback. And then a push to new highs. Now we have an ongoing correction from the higher high, which was marked as unconfirmed on FGSI and IGSI. The pullback again couldn't touch ML, which means buyers are still in good shape. We also had a large bullish EE set up on FGSI. As long as buyers hold price above ML, they are in control of the trend. Yesterday's ramp fixed a lot of the technical damage inflicted in the prior 2 days and if today ML is not lost, it's likely we are dealing with a new found up trend.