mcm daily market update 02.Sept.22

Main trend: down

ST trend: up

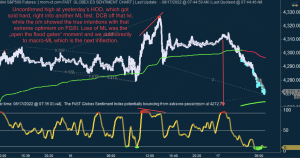

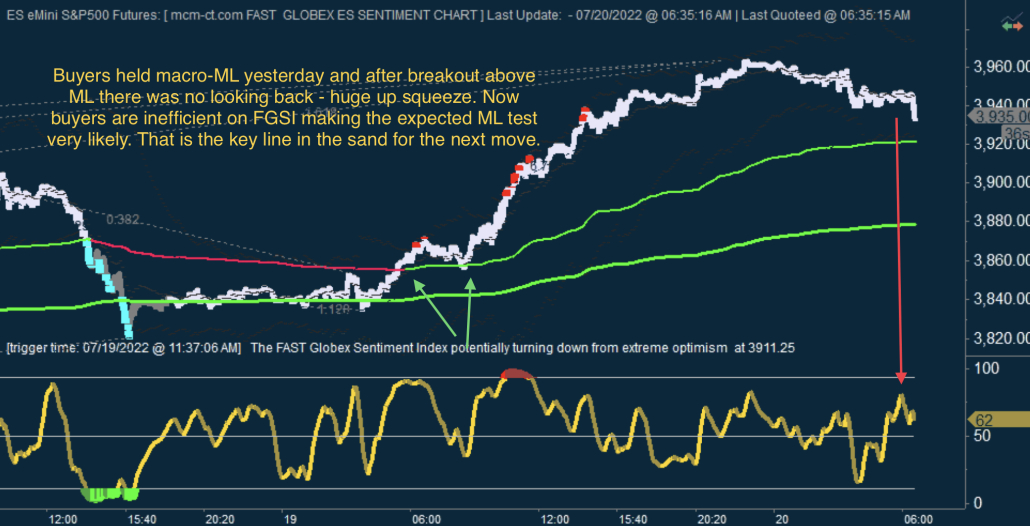

Yesterday we noted that both main and ST trend were down as all MLs were above price and red. Mkt kept getting rejected at ML and making new lows. From and EWT stand point we mentioned that "unless bulls filled the gap quickly... it would need at least a few unwinds of 4-5 waves to finish, so still a few new lower lows". The latter scenario played out with bulls unable to fill the gap in the first 30-60m and instead made a few lower lows, before bulls were finally able to step in near 3900. They bounce hard in the 2nd part of the session and managed to fill the gap before RTH close while closing at the highs.

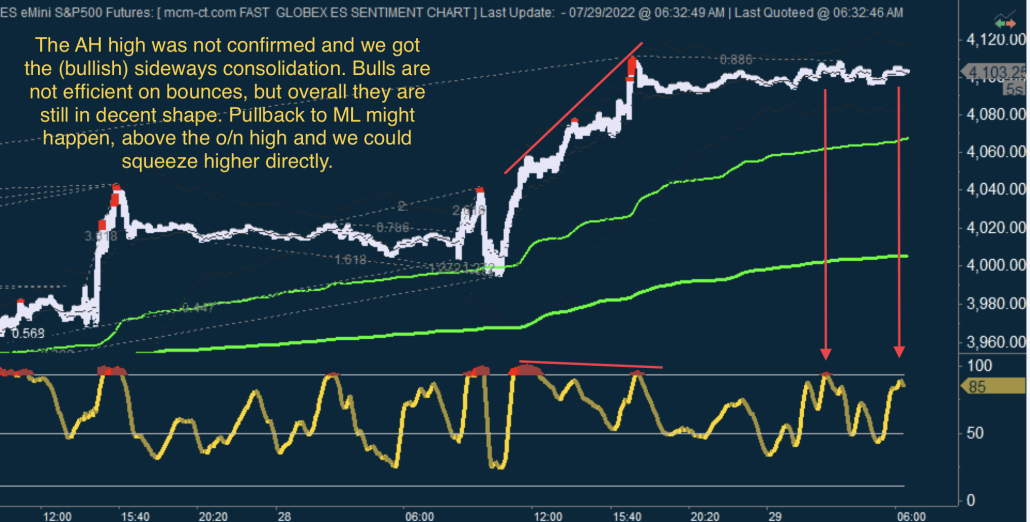

The o/n was balanced. Bulls managed to hold ML on all pullbacks, while the o/n high at 3970 reached early on capped price. Price is compressed here with everyone waiting for NFP numbers to decide on a direction. With NFP good news is likely to be sold as it would mean Fed can march ahead with its hikes and viceversa. The compression zone is o/n HOD at 3970 and ML below. Breakout/down will be important and likely triggered by reaction to NFP.

From an EWT perspective, it seems we finally finished this down wave from 4200 and J-Pow' speech, which kept extending and extending. Normally after such a period price snaps back strongly, so the bounce should have some legs at least for a few days. That being said, this is likely just a DCB (dead-cat bounce) as the move off 4325 is very likely impulsive so after a bounce another impulsive down leg should follow. The "?" is if this move off 4200 is wave 5 as initially presumed, or wave 3. This is now debatable because the 5 extended much more than usual. However in both cases a decent bounce is due. We will have to assess which option is actually playing out after we see more cards.