mcm market update 30.Jan.23

Main trend: neutral

ST trend: down

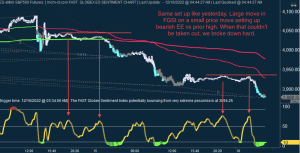

The market rallied relentlessly in the last weeks, with every drop attempt being bought aggressively. Also of note is that the market saw up squeezes in the last 3 consecutive days. So definitely the market was overextended in the near term. Friday saw bulls pushing beyond the 4100 ES mark, but they gave it up in the last 30m when a aggressive 20 point flush occurred.

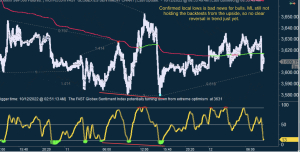

The bigger problem for bulls is that that decline seems to have been only the beginning of what looks like a deeper correction. Sunday and Monday saw continued weakness and we dropped another 40 points from there. Bulls lost ML and price is now directly testing macro-ML. If this line is lost, then trend ML is the last defense for the up trend. Bulls could still repair some of this damage before RTH open, but so far the price action is definitely bearish. Each tiny bounce is pounced on and sold to new lows. Danny has been capping price like a champ.

In terms of the larger picture, it is possible the market is heading back to 3700 area, before heading higher above 4100. It all depends on whether bulls can defend macro-ML and trend ML here. Both are at huge technical levels and if they are lost for more than a head-fake, then that 3700 target would start to increase in odds.