mcm daily market update 17.Aug.22

Main trend: down

ST trend: down

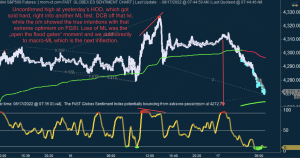

Yesterday we noted that the ST trend was neutral as both sides were inefficient, while the main trend was up as buyers managed to hold above ML. We had some more whipsaws near ML, but finally it was defended once again and buyers then proceeded to yet another up squeeze higher into new highs. What is interesting however is that the new highs stopped suddently and we saw the first impulsive looking decline in quite a while. That decline was bought from ML vicinity and retraced exactly 61.8% Fib ratio, before stopping just near the RTH close. The fact that the up squeeze retraced so quickly and we tested ML again in the same session, was a sign that bulls are losing the trend.

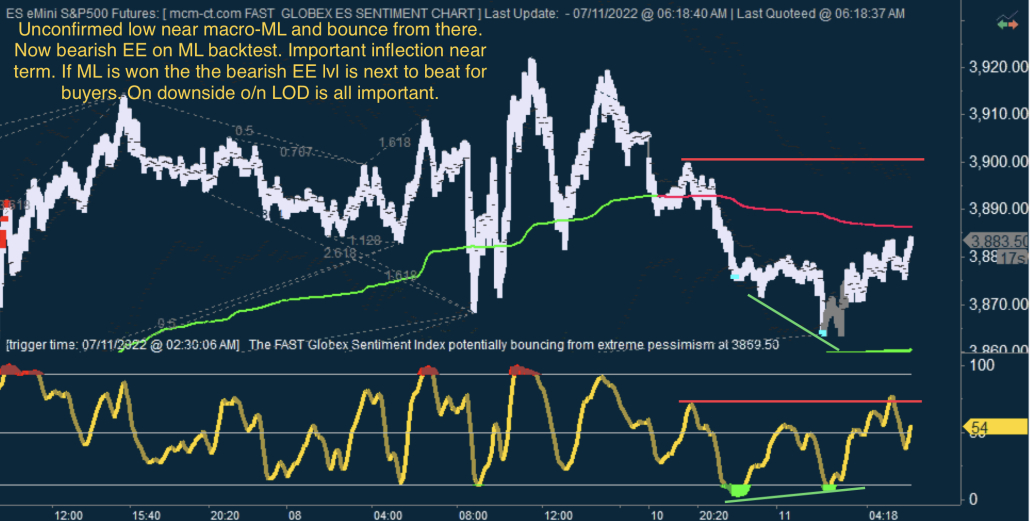

As mentioned several times before, once ML would be lost, the main trend changes. And ML was significanly lost in the o/n session. The o/n moved sideways early on, retested the bounce high from just before the RTH close and failed exactly there. FGSI signaled that short with a nice extreme optimism reading and from there we saw a big drop. Once ML was lost macro-ML would be the next target and potential inflection and we are there already. FGSI is at extreme pessimism, but bulls are having problems getting a bounce together, so the decline can continue for a while. Danny is the main line which should be watched for a change in the ST trend. Once bulls manage to win it back, that would signal a larger bounce can start. ML and 400bar MA are next key lines for upside. And unless bulls win back ML, the assumption is that we found an important top at yesterday's HOD. All 3 GSIs were showing unconfirmed highs there (IGSI and MGSI had their 2nd consecutive unconfirmed high reading), which means the prerequisites of an important medium-term TOP are there, while the break below ML confirms that set up.

EWT wise, it is possible the the entire move off the 3646 low is done and we have started the next large down leg. We have what looks like a large ABC zig-zag off there and because the C is so large (touched the C=2xA at yesterday's HOD), it can always turn into an impulse. Personally I doubt that will happen, so my current assumption is we have topped and it's STR (sell the rip) time for a while now. The bulls can invalidate this assumption if they overlap yesterday's lower high from before the RTH close.