mcm daily market update 23.Aug.21

ST trend: up

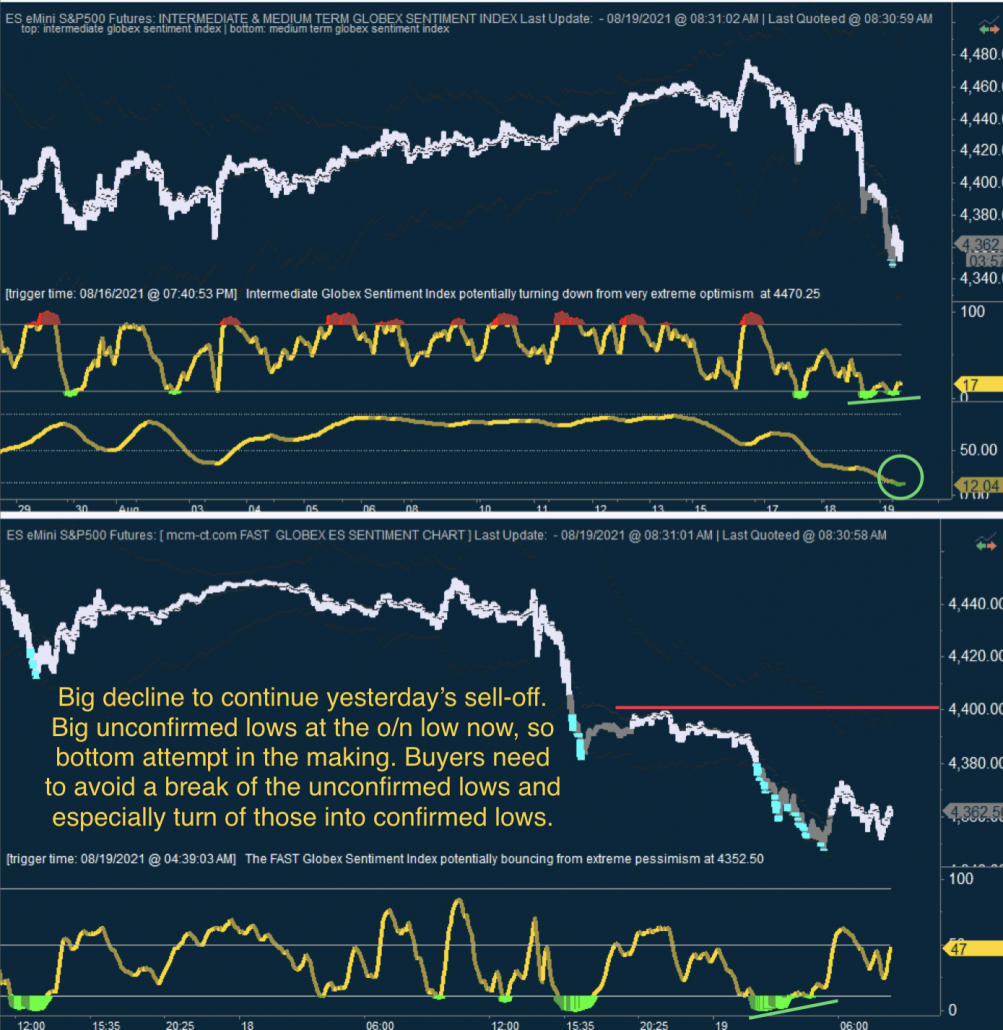

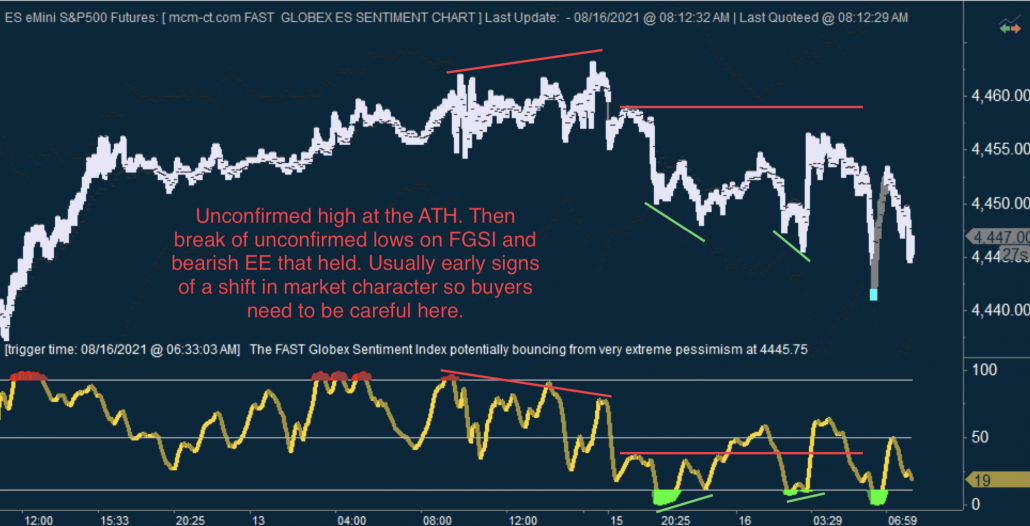

On Friday we were noting that the ST trend was neutral as in the o/n (ES was at 4385 at the time), both sides were looking inefficient via FGSI. We did warn however that "A sustained move above ML would reassure that the bottoming attempt from yesterday is playing out and the "OPEX scare" is over". Buyers did exactly that, broke the bearish EE lvl, won back ML and never looked back. We did not expect a large move considering the OPEX Friday, but apparently MMs were satisfied to keep just the big names (AMZN, AAPL) in check and the index ran regardless.

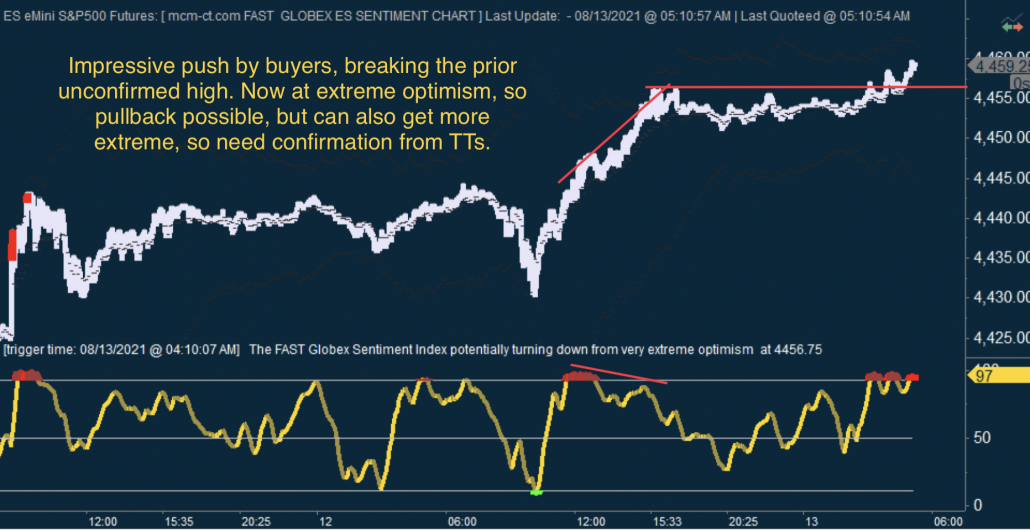

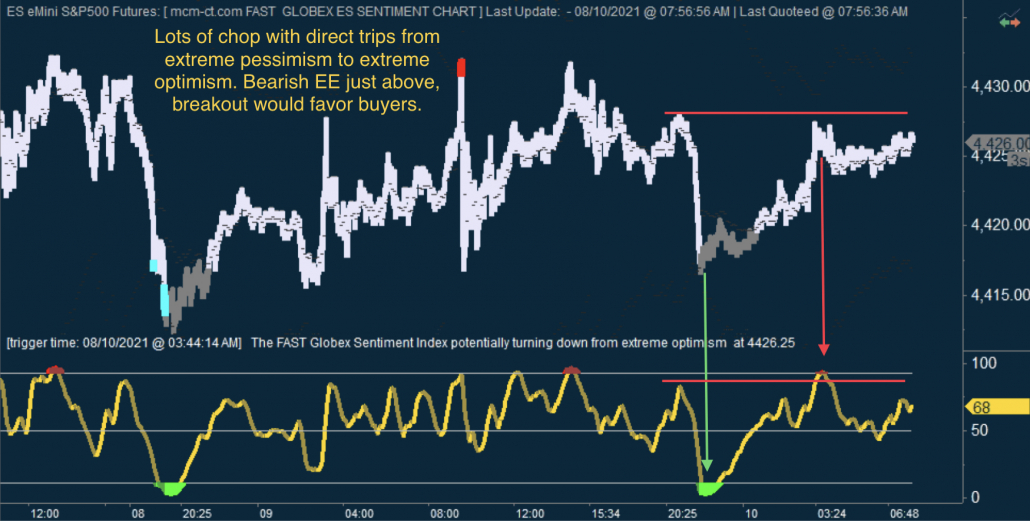

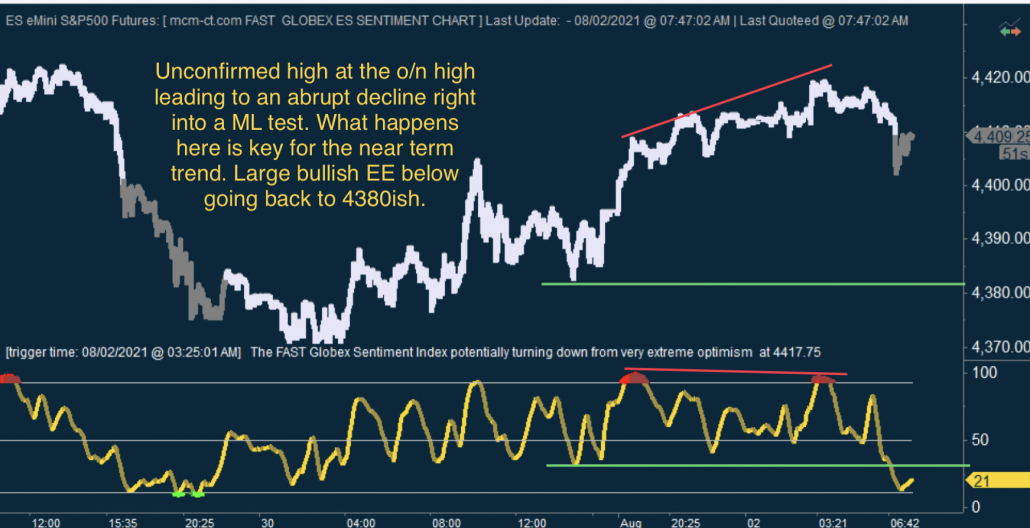

Sunday brought more bullish developments, as buyers continued the up move and broke the unconfirmed high that was registered on Friday on FGSI. They also broke the initial bearish EE lvl set-up on IGSI on the 1st bounce off the big low from last week. The only issues for buyers are the fact that the recent high is unconfirmed on both FGSI and IGSI; and FGSI is showing buyers are also inefficient on this bounce. Those things can still change if buyers continue higher, so they still look to be in decent shape. Ideally they would break the unconfirmed highs before getting a retrace to "cool off" FGSI and IGSI. Depending on whether they can do that or not, we will have more info. A ML test from here would be normal (especially since ML was pulled up by price and is likely not far below). The test should hold if this is to continue immediately higher. If ML breaks, then a deeper retrace could come, but in the larger picture it's hard to see how sellers can avoid new ATHs coming.