mcm daily market update 03.Dec.21

ST trend: neutral

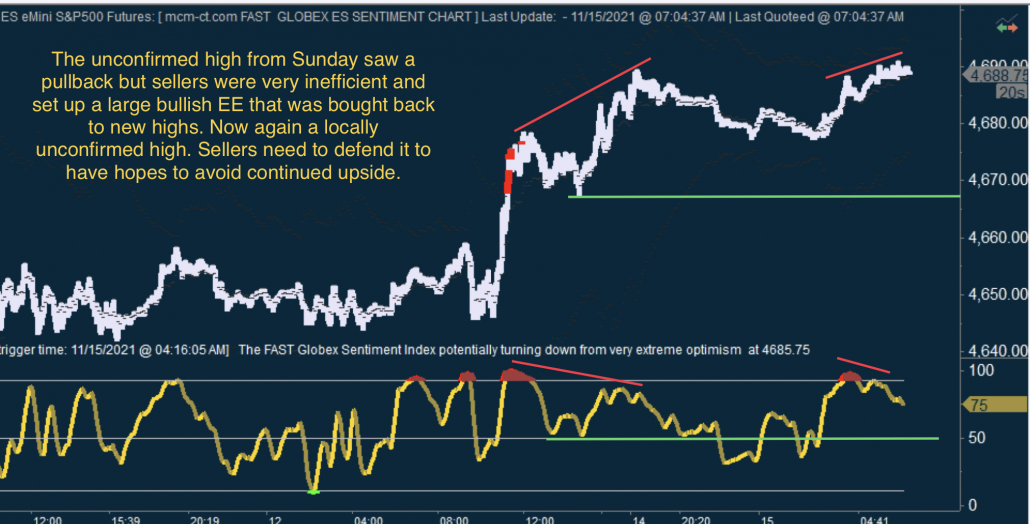

Yesterday we were noting that the ST trend was neutral, as both sides were inefficient via FGSI and set up both bullish and bearish EE. And we noted that breakout/down of those levels would be telling. The market initially broke down the bullish EE, which led to a decline that tested Wednesday's lows. That test coincided with an unconfirmed low set up on FGSI and buyers managed to step in there are arrest the decline. They tested ML, which rejected the 1st time, but then managed to hold yet another higher low and won ML back the 2nd time around and managed to hold above until the close.

The o/n saw price coming back to test ML once more. We even broke below it, but buyers managed to step in and stick save it close by and then won it back. ML got tested once more and this time buyers managed to make a higher low. Sellers are inefficient on FGSI and the 2nd decline to ML triggered a bullish EE lvl. The problem is that also buyers look inefficient on FGSI, so the trens is neutral. ML is the big line in the sand for the trend. Buyers need to keep holding above it to have hopes at more upside.