mcm daily market update 28.Feb.22

ST trend: neutral

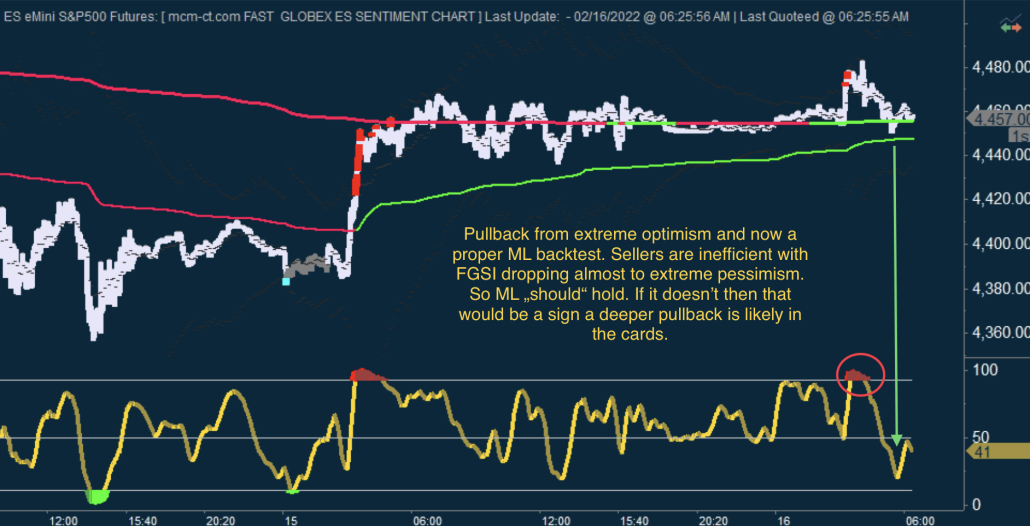

On Friday we were noting that the ST trend was neutral as the market had consolidated in the o/n following the push on Thursday and was back-testing ML. We did mention that "As long as buyers hold ML, they could continue to push higher immediately" and that played out nicely. ML held price and buyers pushed to gain macro-ML as well, which had a text book back-test before the final push upwards. Mkt closed Friday' session at the highs, which proved to be a bull trap.

Sunday opened with a huge gap down based on the escalation to Russia-Ukraine conflict and the 1st use of the words "nuclear deterrent". Despite the big gap down, sellers didn't accomplish too much, as buyers managed to step in and stick save ML. Further on, sellers dropped the ball as FGSI showed they became inefficient on pullbacks. ML continues to be the KEY line in the sand for the ST trend. If buyers can continue to hold it as support, this can go to RTH gap fill which will be the next upper inflection point. Alternatively, if sellers manage to break below ML and take out the 1st bearish EE level (just below ML), then that would indicate that this decline wants to go deeper.