mcm daily market update 15.Nov.21

ST trend: up

On Friday we were noting that the ST trend was neutral, as price was stuck in a range and both sides were showing inefficiency on FGSI. We had both bullish and bearish EE at the ends of the chop range, and mentioned that breakout would be telling. ML was also close by and that also provided nice clues. Price chopped around in the range for a bit more and off the cash opened dipped below ML slightly. However buyers were able to stop very close and once they broke back above ML there was no looking back.

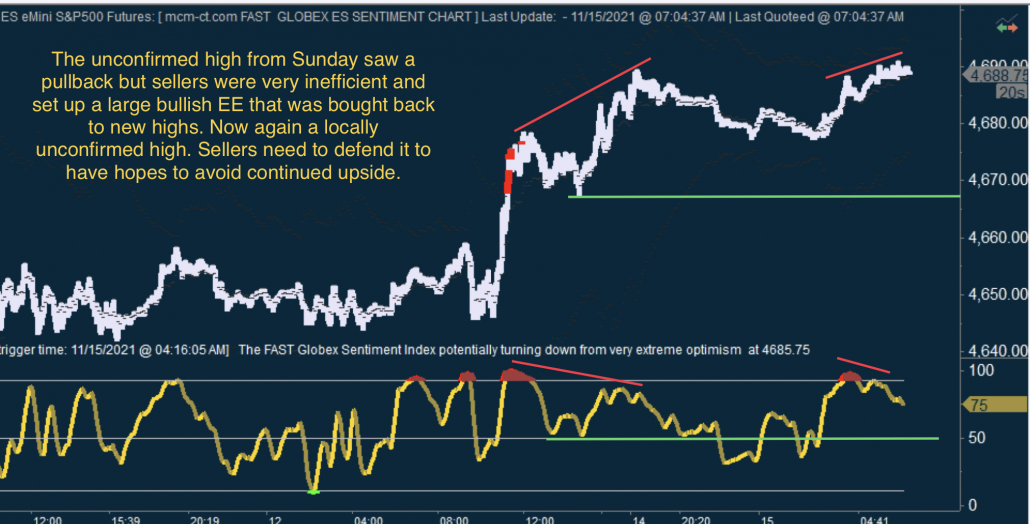

Buyers continued to dominate on Sunday, making new highs above Friday. Today we had the usual pullback from the Sunday high, but buyers stepped in quickly to buy the dip and we made another high vs that one. So buyers are in control, as sellers continue to look inefficient on pullbacks. We do have IGSI stubbornly refusing to confirm the highs and FGSI setting up another locally unconfirmed high, so there is the potential for a reversal. The important TT lines (danny, 400bar MA and ML) must give way though. So far danny held support, which limited pullbacks. Once danny finally gives way, 400bar MA is the next inflection. A ML back-test could happen if 400bar MA also fails and if it does, that would be the big decision point. As long as price is above ML - buyers have the edge and this can continue to push higher.