Home

/0 Comments/in /by mcm-claudiamcm-ct provides a real-time analysis tool-set with Charts, Signals, Spoken Alerts via Tick Tools Livestream, Trading Alerts App via Push/SMS/Email, and Market Analysis for professional and individual investors.

Besides the Livestream Members' streaming charts, mcm-ct offers additional sophisticated analysis and tools with enhanced, professional capability for Expert Members on the website. Our tools are timely, accurate, and accessible via iPad, trading workstation, laptop, mobile phone, and internet device. In addition, mcm-ct provides support with market analysis and a live Conversation Room, with a great community to get the most from all members' tools. Through the development of advanced and proprietary data processing, analytics, and technology for markets, mcm-ct seeks to implement intelligent and innovative tools that give an edge in a complex and competitive environment. Connect with Market Emotions.

E-TICK TOOLS – High Probability Inflection Points

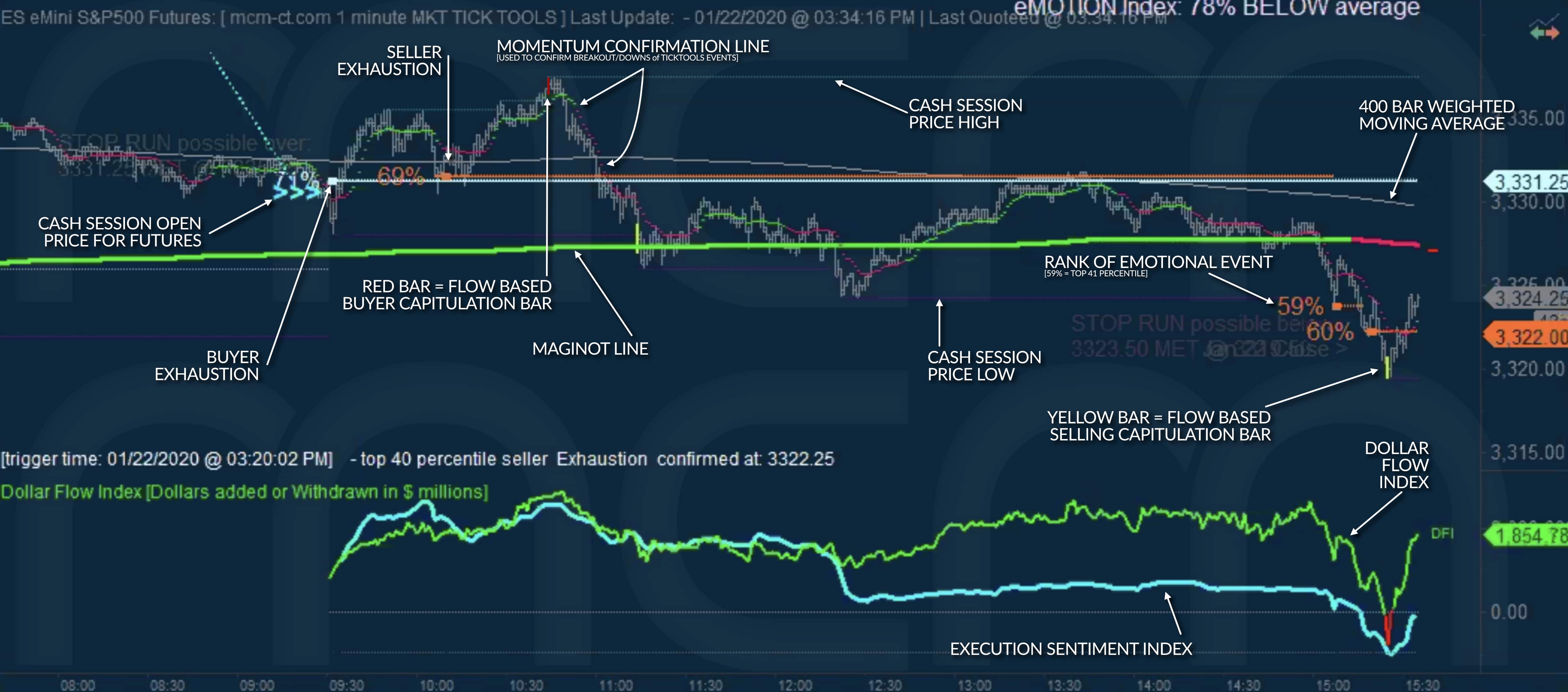

Our flagship toolset is a technology called e-Tick Tools. The core area of focus of e-Tick Tools technology is: real-time analysis, measurement, ranking, and representation of market participant eMotions behavior, and market impact.

e-Tick Tools represents a unique proprietary non-correlated, and non-lagging approach to equity index behavioral price analysis. When near high probability inflection points, it produces prescient and quantifiable feedback at operative prices. This capability is achieved based on the trade-level analysis of market participant behavior and exertion levels. e-Tick Tools enables the ability to gain real-time statistically relevant analysis of what traders are doing within markets at extremes.

There is NO other toolset we know that reliably establishes a high probability of what market participants are doing. (Read more by clicking on "E-TICK TOOLS")

GLOBEX SENTIMENT INDEX - Market Participants Emotion

The Globex Sentiment Index [GSI] is an excellent tool for showing market participant's pessimism/optimism at any given time. Trading GSI is a high probability actionable tool and greatly enhances using traditional shorter timeframe assessments like trendlines/resistance breakouts/downs and cycles. Additionally, GSI offers a unique structure: Bullish/Bearish Excess Energy emotional imbalances - which are great implications of potential inflection points when most tools don't even know they could be there. (Read more by clicking on "GLOBEX SENTIMENT INDEX")

EXECUTION SENTIMENT INDEX - Market Emotions

The Execution Sentiment Index is a visionary and powerful instrument to gauge what traders are doing, whether the market is being bought or sold. The index includes unique ways of feedback intensity: cash flow into and out of equities on a daily and accumulated basis, share price momentum and directionality, up and down trade ticket executions. (Read more by clicking on "EXECUTION SENTIMENT INDEX")

mcm-Subscriptions

CYCLE TOOLS - Market Impulses, Trend Osciallator

There are quite a few charts that employ the mcm-Cycle toolset. There is a reason: cycles produce impulses similar to an Elliot-wave concept of IMPULSE but more objective and concrete & real-time. They are CYCLIC ENERGY and structural measures (Read more by clicking on "CYCLE TOOLS")

LEVELS - Market Support and Resistance

Support and resistance are critical for assessing markets and making decisions regarding them. mcm-ct uses an innovative technological way to build the REAL support and resistance levels the market has created. 1- and 5-minute charts build a database of every inflection point, evaluate their importance, and provide dynamic feedback and access to this most critical data. (Read more by clicking on "LEVELS")

GAP TOOLS - Analyzing First Minute Of Trading

GAP TOOLS offers real-time analysis of gap scenarios, including emotion, volume, strength, and velocity to create gap projection probabilities computed within the first minute of the cash session. Understanding the percentile ranking of a gap emotion is a powerful tool. It shows remarkable prescience about volume, dollars added, dollars withdrawn, and range of outcome probabilities very early in the session. Time frames for the high of the day, low of the day, break-down, reversal, and fill possibilities are significant inputs in understanding the most likely behavior for a gap as it occurs. (Read more by clicking on "GAP TOOLS")

Please note that all the data provided should not be relied upon for settlement or other purposes. mcm-ct makes no representations or warranties regarding the accuracy and timeliness of the data provided and shall not be responsible for any parties’ reliance on any such data or conclusions drawn by using it.

Home

/0 Comments/in /by mcm-claudiaGet a clear direction of the market trend!

Tangible tools that allow you to analyse time frame and position size!

Limit fear and greed impact on your trading.

Find a healthier trader psychology towards risk management and gains.

mcm offers OBJECTIVE TOOLS that give UNPRECEDENTED insight into the markets. With extensive technology and markets experience, mcm seeks to implement elegant and innovative tools that provide an edge in a highly complex and competitive environment. This website represents a significant step in that direction, by seeking to provide sophisticated analysis and tools that can be delivered in such a way as to require virtually no technology infrastructure, staff or sophisticated equipment or databases - yet provide a significantly enhanced capability for clients Our tools are designed to be timely, accurate and ubiquitously accessible - Ipad, trading workstation, laptop, phone, internet device - does not matter, our technology delivery is designed to be as flexible as possible and work where and how you do In addition to technology solutions, mcm has a commitment to providing education, live analysis room, and a moderated/directed community to support getting the maximum potential from our products

Find out about our subscriptions....

Gap Tools

A core capability of the mcm toolset is market structure. GAP TOOLS as a key benefactor of our advanced market structure and emotion analysis.:

real-time analysis of gap metrics, including emotion, volume, strength and velocity.allow for gap projection probability tool kit computed within the first minute of the cash session

Understanding the percentile ranking of a gap emotion, volume, dollars added/dollars withdrawn and range of outcome probabilities are powerful tools that we use to show great prescience very early in the session. Time frames for the high of day, low of day, break-down, reversal and fill probabilities are all significant inputs in understanding the most likely behavior for a gap as it is occurring. More often than not, the expected outcome correlates highly with what occurs in reality - contrasting greatly versus using instinct, emotions or crude statistics to analyse a gap.

e-Tick Tools

Our flagship tool set is a technology called e-TICK TOOLS. The primary area of focus of this technology is:

streaming real-time measurement, ranking and representation of market participant eMOTION, behavior, and market impact.

e-Tick Tools represents a unique proprietary non-correlated and non-lagging approach to equity index behavioral price analysis. It produces prescient and quantifiable feedback near high probability inflection points and prices without lag. This capability is achieved based on trade level analysis of market participant behavior and price levels of exertion. There is NO other toolset we know of with which to reliably establish with such a high probability what market participants are actually doing.

e-Tick Tools enables the ability to to gain real-time statistically relevant analysis of what traders are doing and when they are acting to within markets at extremes.

Price Tools - Market Support and Resistance

Support and resistances are critical for assessing markets and making decisions regarding them. mcm uses and innovative technological way to build the REAL support and resistances levels that the market has created by building a database of every inflection point on 1 and 5 minute charts - evaluating their importance and providing dynamic feedback and access to this most critical data.

Accumulation and eMotion Indexes

Accumulation and eMOTION Indexes are mcm proprietary indexes...that are unlike most any other metric. Accumulation index is a prescient and powerful instrument with which to gauge what traders are doing whether the market is being bought or sold and includes unique ways of evaluating intensity. Accumulation Components are individual metrics that determine true cash flow into and out of equities on a daily and accumulated basis, share price momentum and directionality and up and down trade ticket flow.

Market Structure Tools - Projection

As stated previously, a core capability of the mcm toolset is market structure analysis. MARKET STRUCTURE TOOLS are built on a proprietary and unique database of market structure down to 30-minute resolution that the mcm tool-set maintains and builds.

Sophisticated and proprietary algorithms for real-time analysis of comprehensive market structure enables the projection forward of time windows, directionality, likely biasing and market type,

These techniques, the mcm toolset, can create precise and accurate projection of market structure from intraday to time frames spanning years. The results, more often than would normally deemed possible, are stunning and prescient. Imagine being able to look forward into markets with a high probability directional analysis. What our current implementation of market structure projection CAN DO is project forward likely timing and direction bias. What it CAN NOT DO is project forward scale of directional movement - this is not an attribute considered core to the objectives of the tool-set at this point.

Visit Our FREE BLOG

NOTE

July 13, 2023/by mcm-Alexmcm market update 30.Jan.23

January 30, 2023/by mcm-Alexmcm daily market update 21.Dec.22

December 21, 2022/by mcm-Alexmcm daily market update 16.Dec.22

December 16, 2022/by mcm-Alexmcm daily market update 6.Dec.22

December 6, 2022/by mcm-Alexmcm daily market update 21.Nov.22

November 21, 2022/by mcm-AlexI use the e-Ticks Tools & Accumulation Index Detail every day. They are a great addition to my arsenal -- very valuable..

Tick Tools is remarkably accurate even in the most volatile price action

I use e-Tick Tools daily and have been highly successful!

Amazing, Awesome and Accurate

Tick Tools have proven to an invaluable addition to my trading strategies on virtually every dynamic level of managing a trade.

Gotta love them Tick Tools!

Charts are great. Still learning, but these charts and signals are awesome. Thanks so much

For your tick tools! Amazing!

Love your projection tools!

Amazing tick tools warning of rampalooza!

Out'freakin'standing.

I keep Tick Tools open before I make trades, check for extremes and use accumulation index to get a feel for market.

Had a good day thanks to Tick Tools

Thanks for that emotion index!

I love using the market structure projections for overall direction; I use also accumulation index & emotion index too.

I am thinking. Outstanding!

beyond awesomeness. thank you

Simply amazing accuracy!

Tick...tools....are.....awesome!

Wonderful work!

excellent tools.

amazing skill.

Excellent charts. Superb.

Tick Tools nailing it again today. Awesome

Incredible systems and projections!

. The "stop-runs" triggers work great and are successful 8 out of 10 times.

Your tick tools are incredible. Thanks

Really liking TICK TOOLS. Thanks

Fantastic work! Thank you!

Absolutely FANTASTIC projection work!

Projections Called it boss. Santa was handing out lumps of coal. Nicely played

amazing projections! Spot on!

These charts are perfection 🙂

I use the buy and sell extremes as points to take risk off

I use e-Tick Tools to pinpoint safe entries and exits, especially the X-Ticks and the confirmed buy/sell extremes

I am trading against computers and having a computer program such as tick tools to analyze trading real time is great.

e-Tick Tools are a truly unexpected blessing

I am using all these great tools together with my counts and find they very well together.

Wonderful work!

excellent tools.

amazing skill.

Excellent charts. Superb.

Tick Tools nailing it again today. Awesome

Incredible systems and projections!

. The "stop-runs" triggers work great and are successful 8 out of 10 times.

Your tick tools are incredible. Thanks

Really liking TICK TOOLS. Thanks

Fantastic work! Thank you!

Absolutely FANTASTIC projection work!

Projections Called it boss. Santa was handing out lumps of coal. Nicely played

amazing projections! Spot on!

These charts are perfection 🙂

I use the buy and sell extremes as points to take risk off

I use e-Tick Tools to pinpoint safe entries and exits, especially the X-Ticks and the confirmed buy/sell extremes

I am trading against computers and having a computer program such as tick tools to analyze trading real time is great.

e-Tick Tools are a truly unexpected blessing

I am using all these great tools together with my counts and find they very well together.

Please note that all the data provided should not be relied upon for settlement or other purposes. mcm-ct makes no representations or warranties regarding the accuracy and timeliness of the data provided and shall not be responsible for any parties’ reliance on any such data or conclusions drawn by using it.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

OKLearn moreCookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, you cannot refuse them without impacting how our site functions. You can block or delete them by changing your browser settings and force blocking all cookies on this website.

These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

If you do not want that we track your visist to our site you can disable tracking in your browser here:

We also use different external services like Google Webfonts, Google Maps and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

Legal Privacy Statement