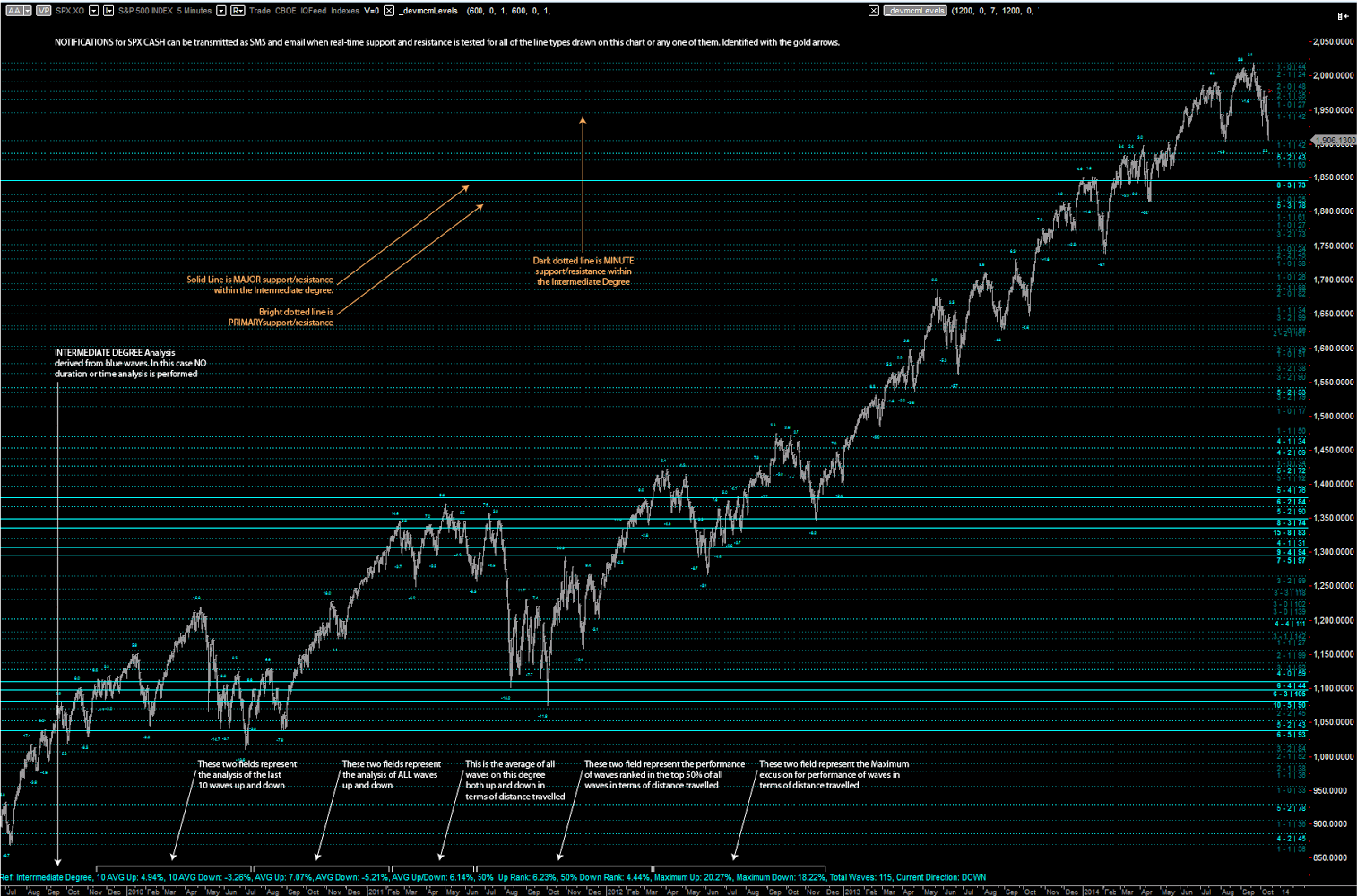

Price Tools – Support and Resistance

Support and resistance in the markets is most often drawn and calculated where it looks good but NOT where it actually is. This is a very interesting fact as, support and resistance is calculated AFTER stops have been run and not before and therefore, in far too many cases improperly places horizontal support and resistance in the wrong place by a significant amount. Our price analysis tool operates unlike any other. It analyses every wave on the cash markets on a 1 to 5 minute basis locates the inflection points where markets turned. Support and Resistance are then rendered based on this data in aggregate. Additionally, the points traveled into and out of, number of times support and number of times resistance are calculated an plotted on charts.

The reason that this technique works so much better than others is that normal market volatility is exempted and ONLY valid market inflection points meeting criteria are accepted for calculation. Additionally, a smart harmonization layer is applied to aggregate the results appropriately by price significance and strength.