mcm daily market update 4.Mar.22

ST trend: down

Yesterday we were noting that the ST trend was neutral as both sides were inefficient via FGSI. The latter was showing a potential large divergence set-up, which normally points to a large decline (80-100 points). It didn't play out exactly, as the prior high was surpassed, but it proved to be correct in the end. We did mention "4400-4420 area has a lot of resistances (classic TA - descending trend lines, 200DMA and BC on daily) and is a VERY tough nut to crack, so risk/reward doesn't favor longs here". The market stopped right near 4420 and then dropped 100+ points.

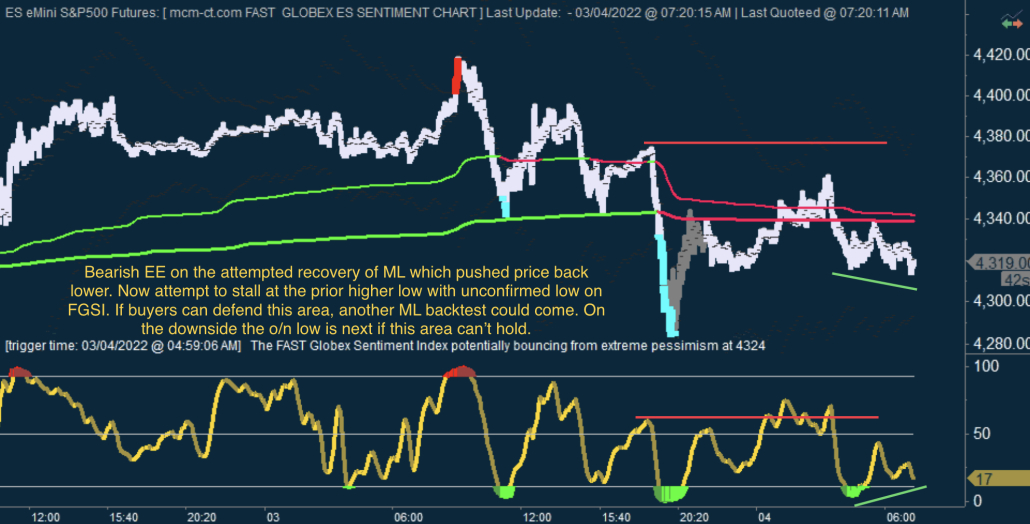

The o/n proved that sellers were indeed in full control. It dropped to test the important 4280 support and bounced 80 points, with buyers attempting to win back ML, but failing spectacularly after that. Now buyers are attempting to hold the area near the prior higher low from the o/n and FGSI is showing a potential unconfirmed low here. That doesn't mean the decline is over, but if buyers do manage to step in here (break above danny would help), then we might see another ML back-test, which would then be the big inflection point (ML is key for the near term trend). For now sellers are in control, at least until buyers can win back ML on a sustained basis. So bounces are sell opportunities, until proven otherwise.