Trading the danny line

Danny is an important line for the intra-day trend. The easy way to use it is - when danny is below price and green, the trend is up. Works the same in the oppossite direction. That is very useful in itself and allows you to never trade against the trend. But additionally there are intra-day set ups based on danny which can help you take consistent trades.

Video: https://u.pcloud.link/publink/show?code=XZNS9GVZoumG1zqs3WYcq3Dzna8wWmqXD76V

1. BE/SE at or near danny This is a VERY strong signal and odds are high it will hold. For example price is above danny and is coming down to test it and a SE triggers there. that's a buy signal with a stop 1-2 points below danny. If the SE at danny fails, then the trend is reversed and shorts should be traded after that.

2. danny tests The strategy is - when the trend is up every pullback price has into a danny test is a buy. Works in the oppossite direction in a down trend day. However additional rules are needed:

- Only buy danny tests when it is green. only sell when it's red.

- the buy can be initiated on the 1st green candle off danny or its immediate vicinity. stop must be either 1-2 points below the most recent low or 1-2 points below danny itself.

- getting a danny test after a prior danny test that led to a lower high is risky since that is the set up for a danny break. should be avoided (described in set up 3.danny reversals below)

- this strategy works best in strong trend days. sideways choppy days tend to whipsaw danny and it's best to rely on additional signals if playing danny tests (like SE/BE or 400 bar MA or ML being close etc)

3. danny reversals Danny reversal are very powerful especially when they come after a strong trend. Once danny is lost for good (no quick spike and recovery), then a decent retrace of the entire move can be expected (sometimes even the entire move).

- Ideal set up is a danny test, bounce to a lower high, then next time danny is tested we breakdown. Entry is either on a momentum line rejection from that 2nd test or the actual danny breakdown. Stop is the prior high or 1-2 points above danny (if danny breakdown is taken as entry)

- it sometimes happens that danny is sliced through directly, when there is strong momentum in the move (for example when price is coming from far away from danny). in this case entry can be on the danny breakout - 1st bar that closes ABOVE danny, with stop 1-2 points below danny.

- the trend reversal is confirmed ONLY if danny is not won back. If the trend reversed, then danny should be acting in the oppossing manner (if up trend was reversed, then danny should start acting as resistance). if danny is won back quickly, then a trade in the direction of the prior trend can be initiated, with the stop below the prior spike low below danny.

- trend reversal is confirmed once danny changes colour

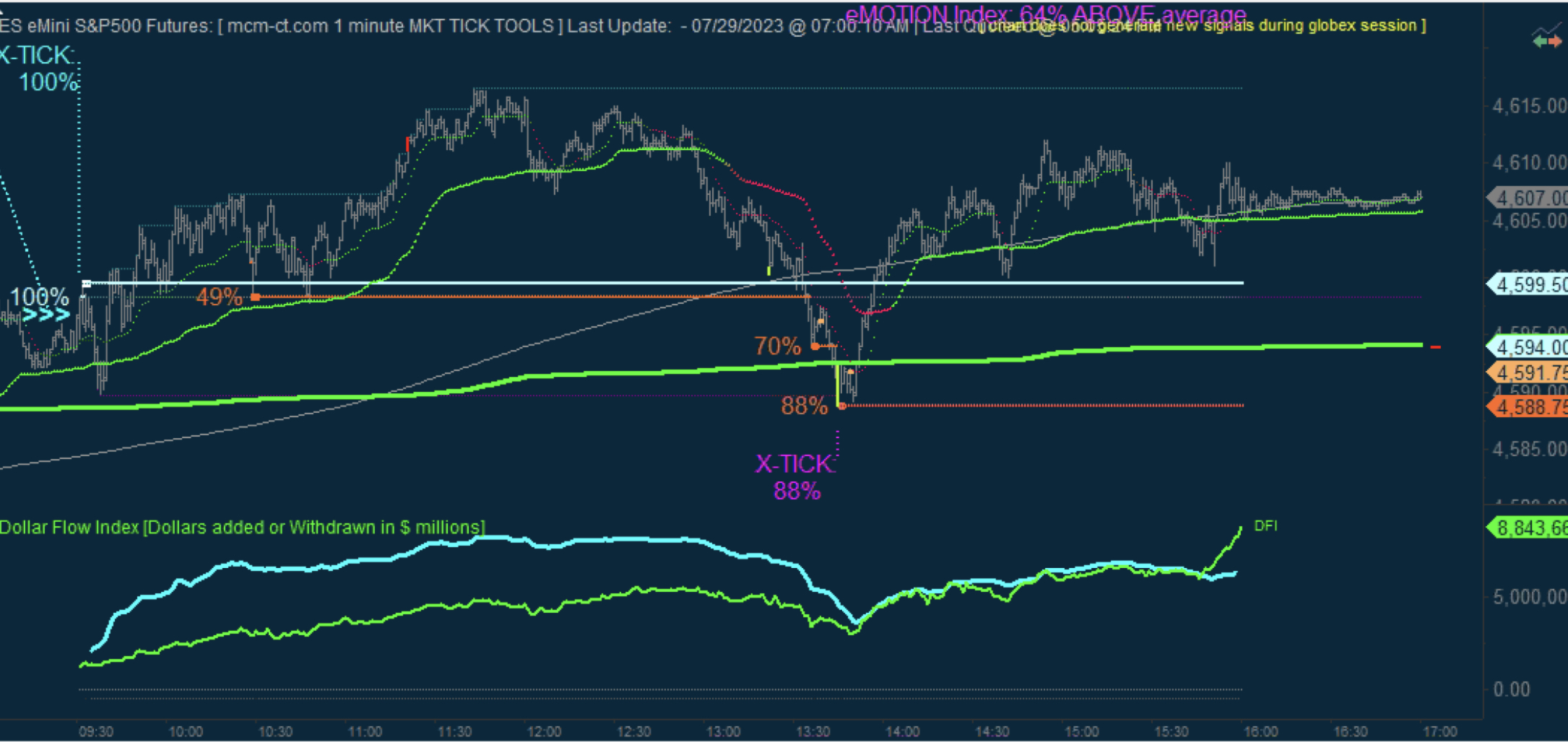

Below is an example in which we had all set-ups in one session.

We had a large gap set up to start the session with a 30+ points gap up. The opening BE acted as resistance initially, but danny below acted as support. Set up 1. worked early on, actually set up 3.3, when initially danny was spiked, but quickly won back. Entry was danny win-back with stop below the spike low. (note: since ML and 400 bar MA were both close below danny, initiating a short on danny breakdown was a risky play. better was to wait for breakdown below all those lines to confirm the short entry).

Then we had a SE at danny at 10:30, which pushed higher to retest HOD, got rejected there and back-tested the SE at danny again. That was decisive for the 1st part of the session. Back-test held cleanly and market pushed higher. Initial entry long was on set up 1. once that 49% SE hit. The 1st PT (profit target) was HOD area. Once we got there, partial profits should've been taken and stops moved at b/e. The back-test was re-entry on longs with stop 1-2 points below danny/SE. again 1st PT was HOD 2nd PT was on break of the most aggressive TL of the up trend.

The next trade on danny set ups was at 12:00 when danny was tested and bears tried to break it down. A short could have been initiated on the danny breakdown attempt, with stop at prior bounce high on the initial danny test (near momentum line) which would've been stopped and could have also been stopped earlier as the quick win-back was a sign it's a fake breakdown and longs are needed again. The stop on the flip long was below the spike low. This new long worked for a retest of the HOD area (1st PT).

Next we had set up 3. From the prior danny test when bulls avoided the breakdown on the last second, price only made a lower high vs HOD and wend back lower to test danny again. This new danny test was risky to buy as said above under 2.3. and 3.1. The market hesitated a bit, so the entry short wasn't easy. 1st attempt to break danny was shy and quickly reversed. 2nd attempt made a lower low, but also stalled just below danny. 3rd time was the charm and finally broke down in earnest. Depending on your trading style (conservative or aggressive), you could have either waited for that initial low to be broken, having a tight stop 1-2 points above or shorted the bounce highs off danny as momentum line was capping price, with stop 1-2 points above those highs. In case you were stopped, re-entry should have been reinitiated once danny was lost again. The main point is that once danny was lost, we had a large move in the opposite direction, which is text-book after an up squeeze like we had on this day (gap up with breakout and further squeeze). The text-book lower target was ML. However, as we had 400 bar MA and the opening BE above it, that was PT1 with ML being PT2. Price hesitated a bit at PT1, but after a weak bounce (capped by momentum line), we broke down to hit PT2 and even overshoot it.

Next set up was near 2pm. Bulls managed to stop the bleeding on a SE Xtick, had won back ML and sliced through danny quickly. That danny win-back was the entry for another long, with stop at the small kink below it on the 1st reaction off it. Price continued vertically nicely and sliced through the BE and 400bar MA before finally peaking near the 4605 area, which was an battle ground all day. At that stage partial profits should've been taken, and stops trailed 2-3 points below danny.

Next we had a pull-back to danny, with 400bar MA also being there, which triggered setup 2 again for a new long. price pushed to a new recent high, before failing to hold and coming back lower. The next danny and 400bar MA test was spiked lower into a test of the opening BE. The long taken on initial danny win and on the danny backtest should've been stopped either near the highs or when the 4605 lvl was lost again. Shorts on the danny breakdown could have been initiated, but with the opening BE so close by, the best strategy would've been to wait for that lvl to be broken too. Instead the lvl held and price won danny back. That triggered another long with stop below the BE backtest low and PT1 the recent high, PT2 HOD. PT1 was hit, then price pushed a bit higher before giving up. Once PT1 is hit, stops are moved at b/e (break-even). Profits can also be booked once the prior highs (in our case the 4605 stubborned lvl) were lost or trailed 1-2 points below danny.