mcm daily market update 25.Oct.21

ST trend: neutral

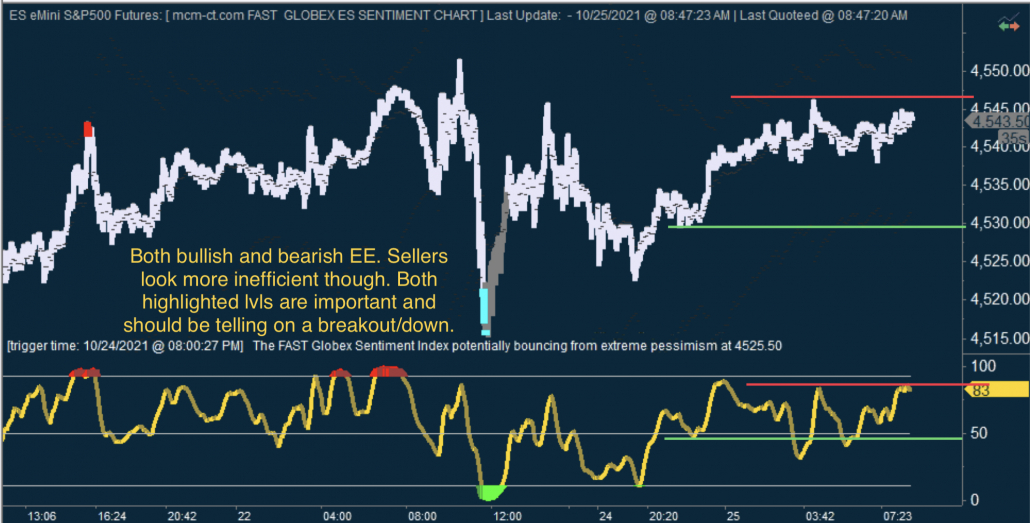

On Friday we were mentioning that the ST trend was still up as sellers continued to be inefficient on eachpullback, while buyers kept pushing to higher highs. After the cash market opened we saw an initial drop, then a push to a new high, which was unconfirmed on FGSI and which was afterwards quickly reversed. The ensuing decline was very steep as we dropped 35 points in a vertical drop, before buyers stepped back in on extreme pessimism on FGSI and a 2nd sequential SE on TTs which also had an Xtick. That nailed the low for Friday and the market bounced right into the cash close.

Sunday saw a drop from those highs until FGSI hit again extreme pessimism zone (just barely), where buyers stepped in again and pushed price back right to the closing highs from Friday. The o/n today showed clearly that sellers are very inefficient (via FGSI) as every drop generated a big move in FGSI and as a consequence was quickly bought back up. It seems that the market is waiting for the cash session to decide on a clear direction. Above the ATH touched early on Friday and buyers could push another 15-20 points before finding resistance. As long as the ATH holds as resistance, sellers have a shot at pushing directly towards Friday's lows. Both TTs and FGSI currently give the upper hand to the buyers as all important lines on TTs (danny, 400bar MA and ML) are below price, while FGSI keeps showing sellers are very inefficient. So unless sellers step in on the cash open, we could see another push higher.