mcm daily market update 19.Nov.21

ST trend: down

Yesterday we were noting that the ST trend was neutral as both sides were inefficient via FGSI. Sellers took the lead early after the RTH session started and accelerated lower to break the bullish EE level. The market found support at extreme pessimism on FGSI and helped by a Seller Exhaustion and buyers were able to stage a V-shaped bottom from there to finish back near the highs.

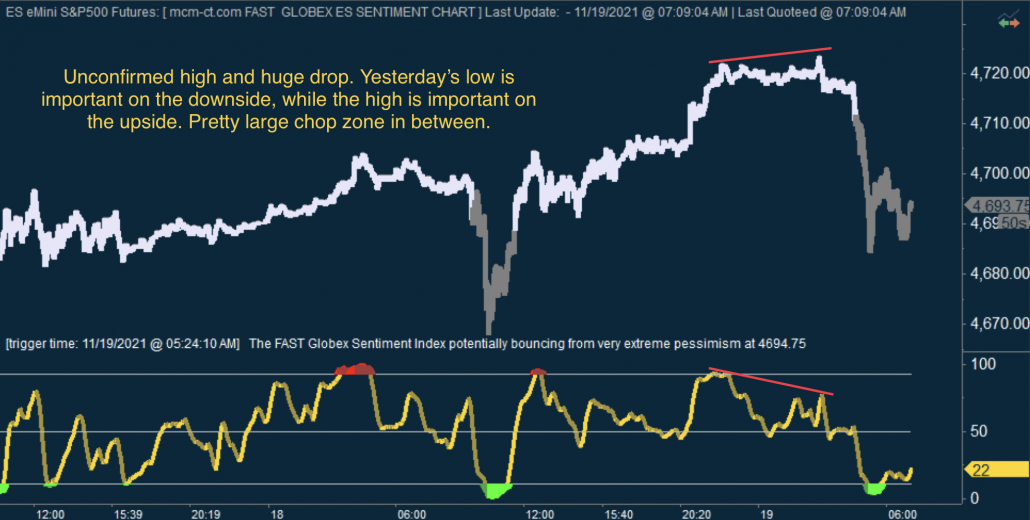

The o/n saw a continuation of the bounce as buyers pushed the price almost ~20 points higher. That high was stubbornly unconfirmed by both FGSI and IGSI and once price failed to hold danny and 400bar MA we started the rollercoaster down again. Buyers also lost ML, which is particularly bad. We did hit extreme pessimism on FGSI again and buyers staged a bounce into a ML back-test, which rejected price. It is OPEX today so wild whipsaws in both directions are to be expected. ML remains important for the trend, so where price settles in relation to it will be telling.