mcm daily market update 16.Dec.22

Main trend: down

ST trend: down

Yesterday I alerted the members in the mcm chatroom that if bulls were unable to defend the opening SE Xtick and at least try to fill the gap, the breakdown would point to 30-50 points lower and we could be in for a strong down trend day. 1st part proved to be conservative as open to LOD was 70 points, while the 2nd part was spot on. TTs provided nice opportunities to re-short or start a short for those who missed the initial breakdown with danny capping price all day and with several BEs which hit (and held). In such strong trend days best is to play the trend until it breaks, which only happened 1.5h before the close with a decently strong bounce. Danny is an amazing line for showing the immediate trend.

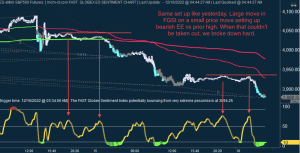

In the o/n we had the exact same set up which we had yesterday in the o/n and triggered the 1st short opp. FGSI bouncing hard on shallow price movement and setting up bearish EE above centerline. The inability of price to conquer the prior high triggered the sell and we sold off 40-50 points, just like yesterday. This sets up another large gap down (if holds until RTH open), and back to back runaway gaps can lead to crashes. That being said, I do not think the market can sustain 2 runaway gaps in an OPEX week. So I would expect MMs to change the tune and attempt to fill it rather than let it run like yesterday. The opening SE will help in identifying if we breakdown again and run or not.

In terms of the big picture, bulls are in big trouble here. They lost the trend (all MLs were broken and are now above price and red) and also the wave structure off the last 4100 high looked like nested bear waves which now confirmed with yesterday's runaway gap. Once they manage to stop the bleeding ,the shape of the bounce will tell us if we are going to revisit the Oct lows or not. In anycase it looks like a bigger retrace is now needed before potential new highs above 4100.