FGSI – Extreme Sentiment values

As previously mentioned, the extreme values in Sentiment Index should be used as a warning signal a reversal is close. It is a great complimentary signal reinforcing other signals (like TickTools exhaustions or Cycle resistance/support) rather that a hard signal to be acted upon alone.

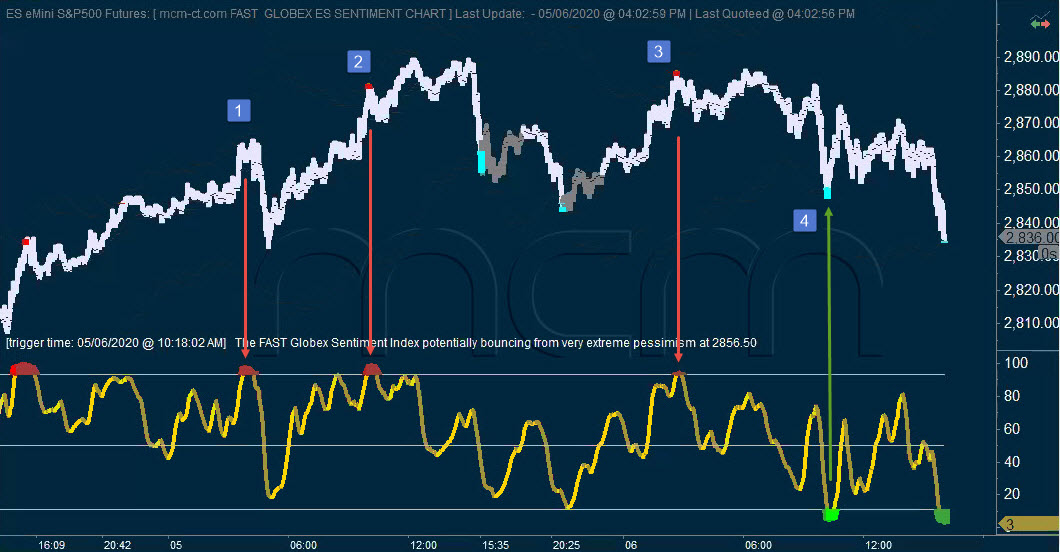

Here is a practical example:

We can see that while at points 1 and 4, price had a strong reaction following the extreme value in Sentiment, at points 2 and 3 the pull-backs were rather small and were followed by new highs, setting up unconfirmed highs, which triggered a much stronger reaction. This will be covered in Practical use - part 3.

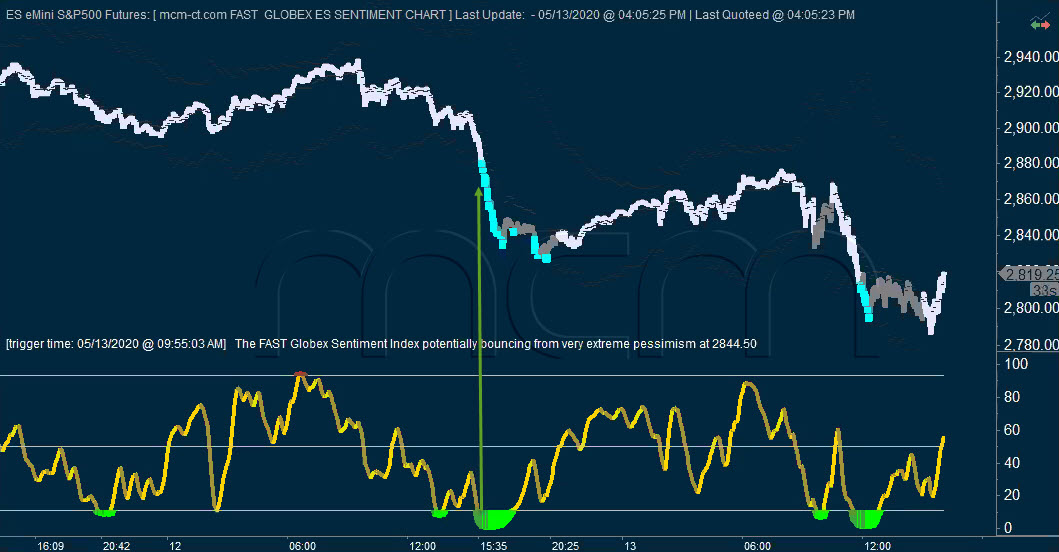

Here is also a practical example of a situation in which Sentiment was held at an extreme value, while price accelerated in that direction.

We can see where the arrow shows, that Sentiment was showing extreme pessimism, however price continued to move lower for a while before setting up an unconfirmed low, which then triggered a bigger bounce. Worth mentioning is that before this big decline in price, the prior extreme pessimism value in Sentiment triggered a very small reaction in price, while Sentiment bounced more, setting up bearish excess energy prior to the big drop.

The main point is - while Sentiment extreme values are a great warning signal, they should not be acted upon alone or considered a "hard" signal to buy/sell.