FGSI – Unconfirmed lows/highs

Unconfirmed lows/highs occur when price makes a lower low (or higher high), but Sentiment makes a higher low (or lower high). This indicates pause/reversal. The reversal can be extremely powerful, especially when coming after a prolonged move and showing several unconfirmed lows/highs.

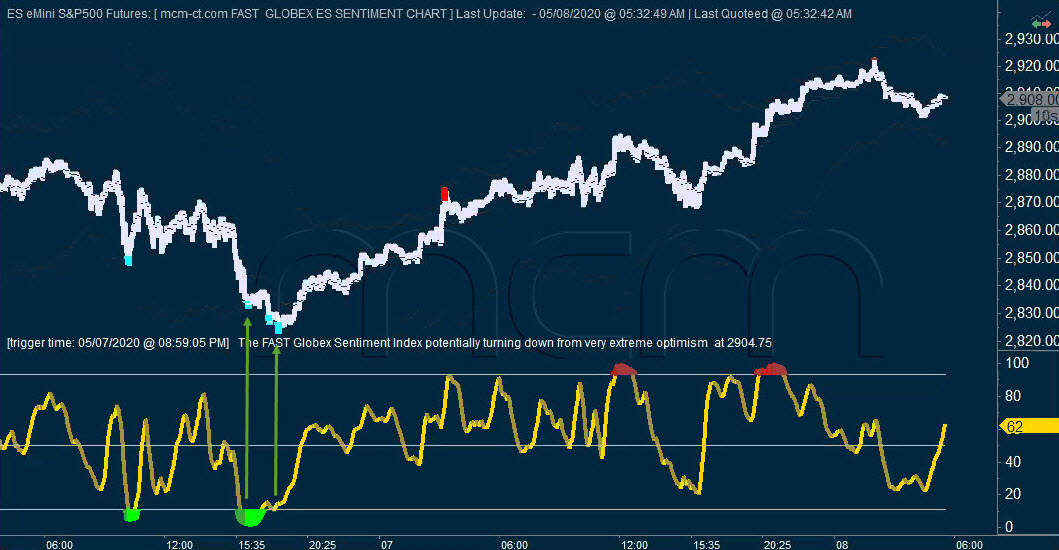

This example shows just how powerful an unconfirmed low set-up can be. The market reversed from the unconfirmed low and basically never looked back.

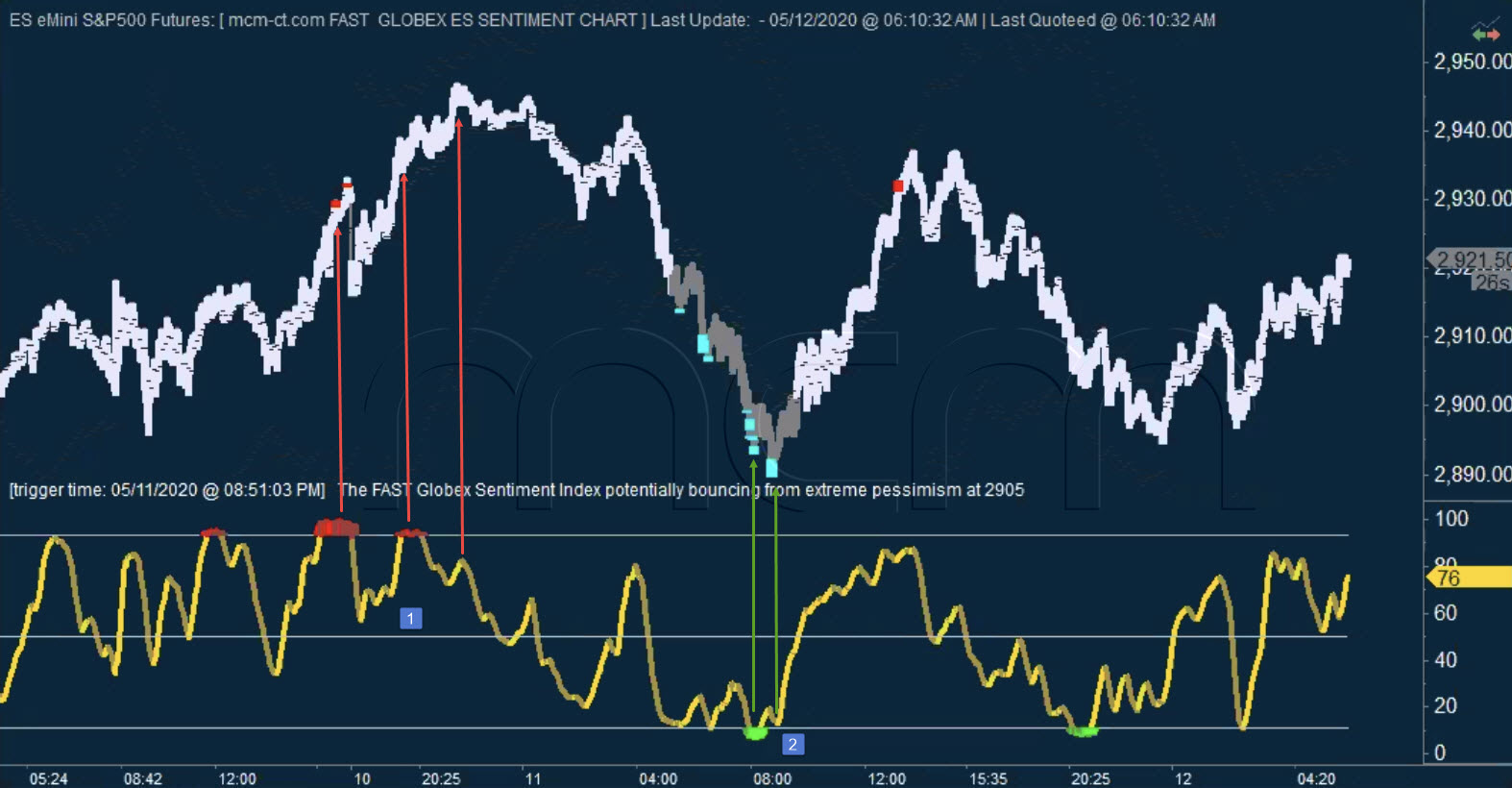

The next example shows 2 back to back set-ups. First unconfirmed highs (at point 1) followed by unconfirmed lows at point 2. Both of which triggered very strong reactions.

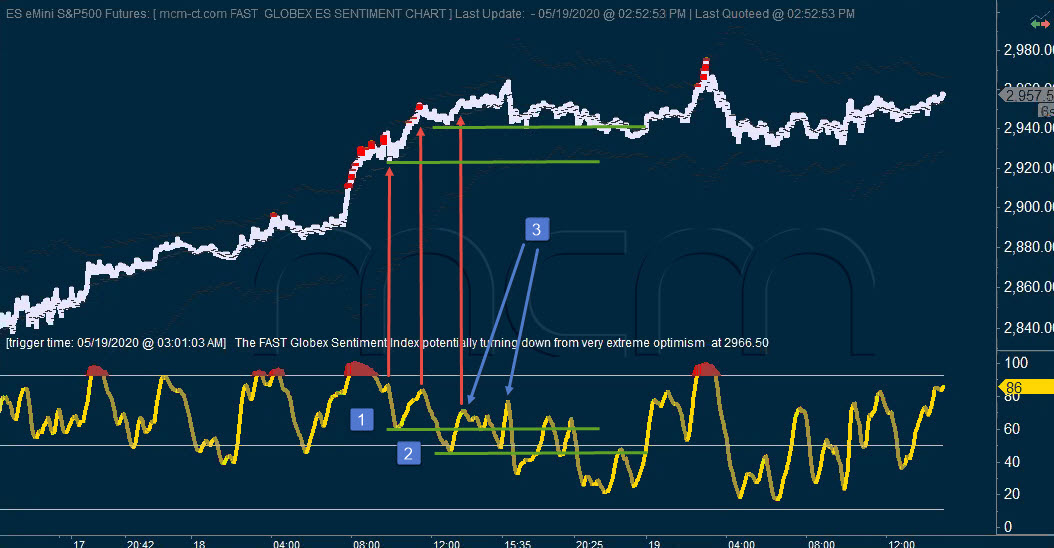

Even though the unconfirmed high/lows can trigger very powerful reactions, as seen above, there are also instances in which the reaction is not as expected.

Below is an example where something else happened and the reversal failed. At point 1, there were 3 unconfirmed highs in a row, from which the normal expectation would've been for a strong decline. However there were a few warning signals that this was not going to be a standard unconfirmed high reversal. At point 2 we actually had a pretty strong bullish Excess Energy set-up, which held. Then at point 3 the market made a confirmed local high. These 2 facts were indicating that the unconfirmed highs were not going to be able to reverse the market and the next decline was contained and then bought to new highs.

In conclusion, unconfirmed high/lows can be extremely powerful set-ups indicating the potential for a strong reversal.

There can be times in which momentum is just too strong in one direction for the reversal to happen. These (rare) instances will likely be signaled by Excess Energy in the direction of the trend, which holds. For a reversal to happen, the Excess Energy (if it shows) needs to be broken through.