GSI – Excess Energy Setups

Excess Energy is a very important concepts of the mcm-ct.com emotion analytics process:

What is EXCESS ENERGY?

its when market emotions are stronger than price action is able to confirm (in either direction).

THEREFORE the following is a summary:

BULLISH EXCESS ENERGY = GREATER SELLING ENERGY/EFFORT WITH HIGHER LOW in PRICE = seller inefficiency

BEARISH EXCESS ENERGY = GREATER BUYING ENERGY WITH A LOWER HIGH in PRICE = buyer inefficiency

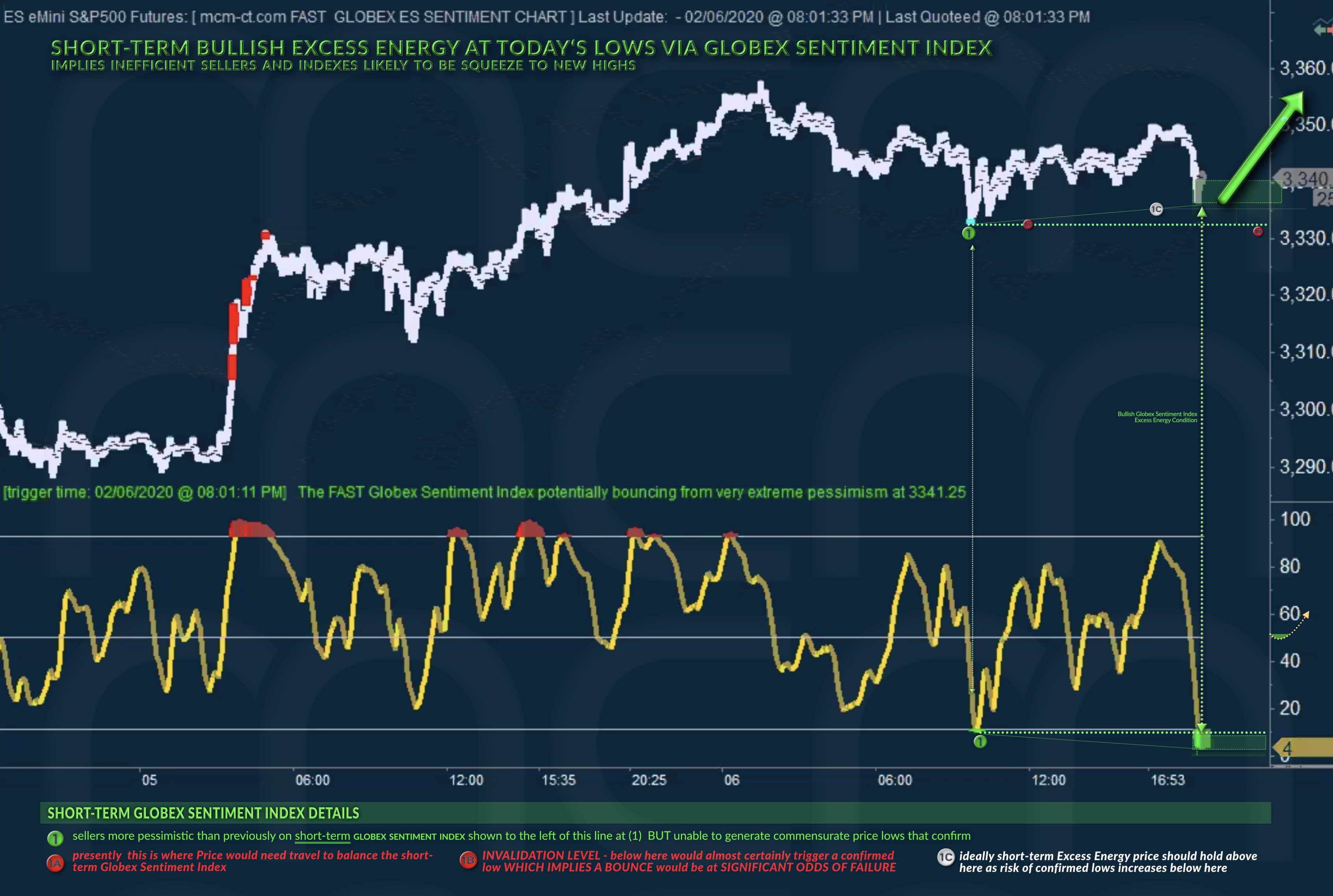

lets look at a live setup:

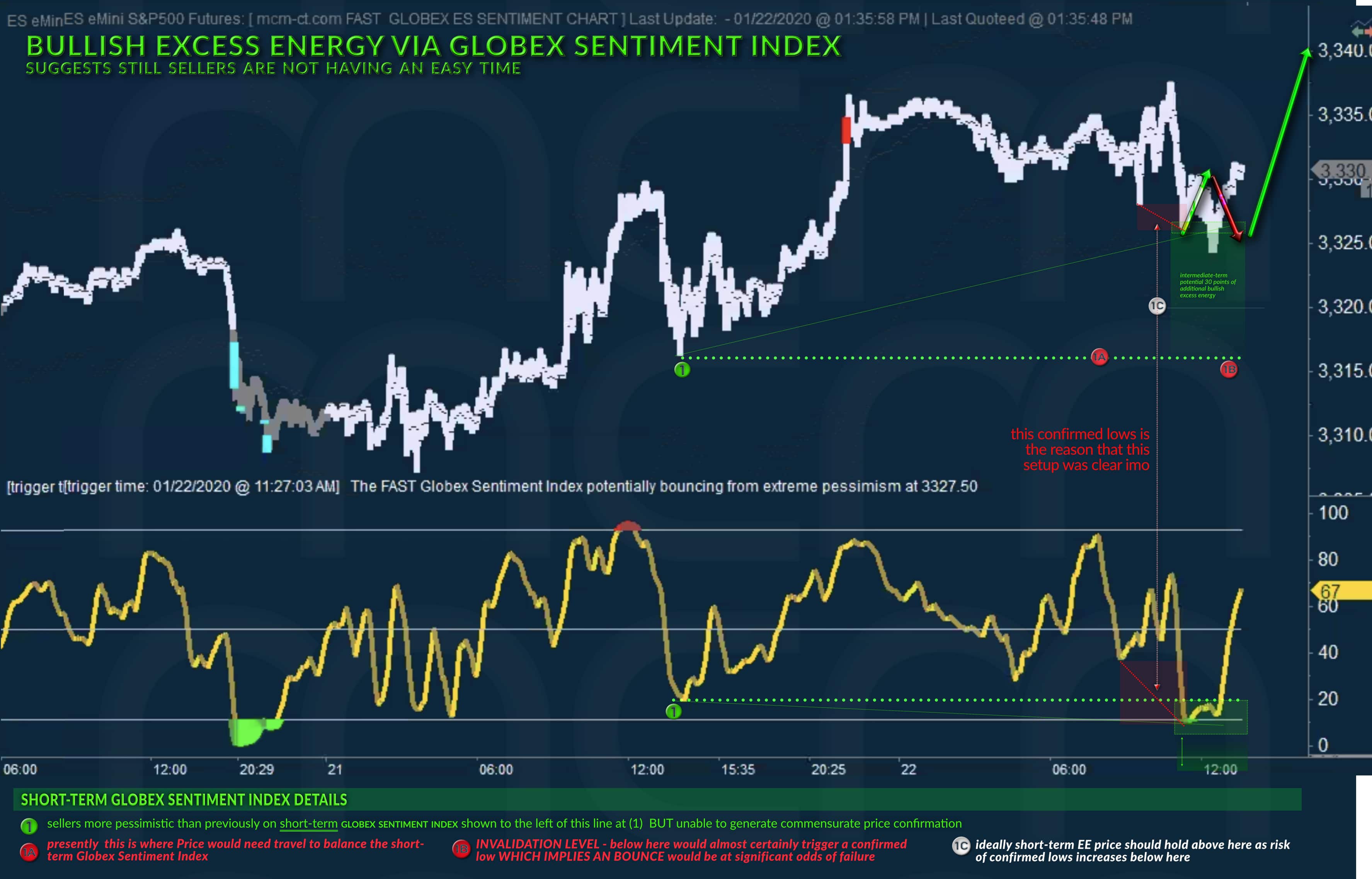

Here is another one that also uses confirmed lows to suggest a retest of lows within a bullish excess energy setup:

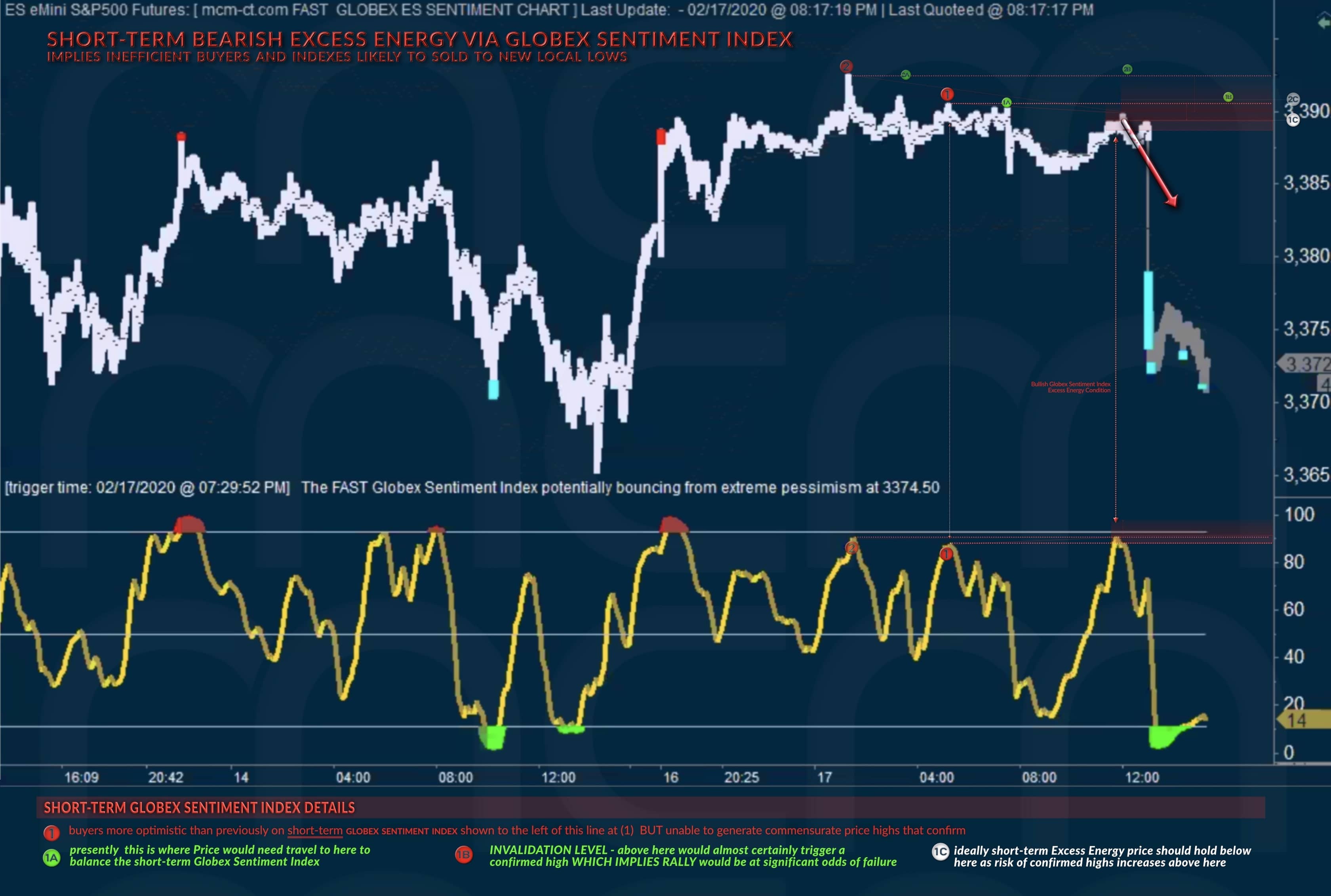

Here is a bearish excess energy setup:

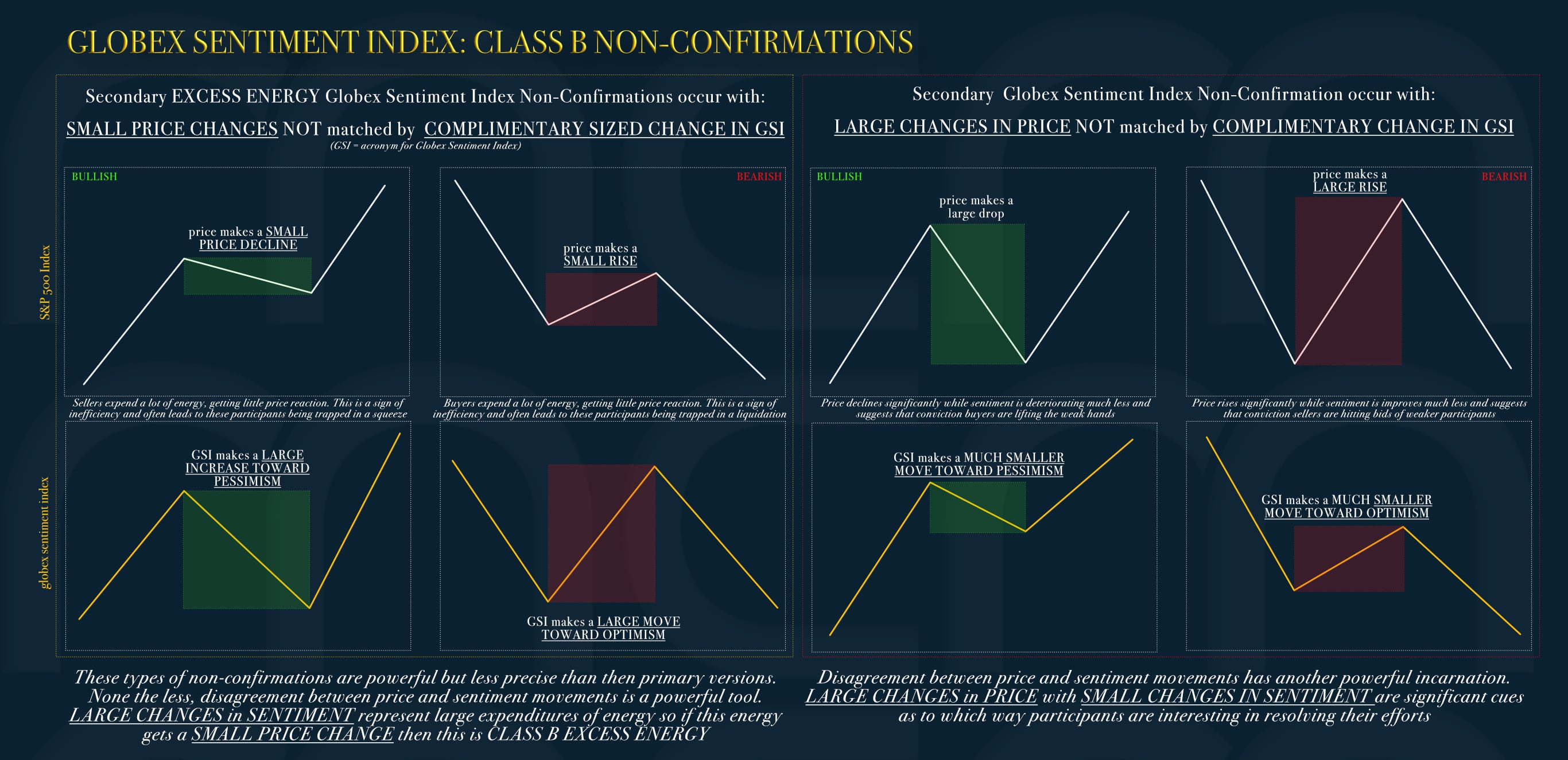

along with Excess Energy come trending indications which are confirmations and trend pause/potential reversal non-confirmations:

CONFIRMED LOWS = SENTIMENT LOCALLY MATCHING PRICE LOWS = SELLER DOMINANCE (seller imbalance) = CONTINUATION

CONFIRMED HIGHS = SENTIMENT LOCALLY MATCHING PRICE HIGHS = BUYER DOMINANCE - (buyer imbalance) = CONTINUATION

UNCONFIRMED LOWS = SENTIMENT LOCALLY STRONGER LOWS THAN PRICE LOWS = SELLERS WEAKENING = PAUSE/REVERSAL

UNCONFIRMED HIGHS = SENTIMENT LOCALLY WEAKER HIGHS THAN PRICE HIGHS = BUYER WEAKENING = PAUSE REVERSAL