GLOBEX SENTIMENT INDEX – Market Participants Emotion

GLOBEX SENTIMENT INDEX is a unique emotional analytic for futures markets and Globex sessions with notoriously little information, data, and feedback available from cash markets.

Trading GSI is a high probability, an actionable process using shorter trend lines and cycles. The index shows extraordinary emotional measures presently focused on the ES futures markets. Very Extreme emotions or mismatches are powerful setups to look for trade setups and provide non-latent/quick responses to market shifts and opportunities. They are virtually impossible to spot with traditional tools.

GSI builds high probability and actionable setups:

Extreme Optimism

Extreme Pessimism

Sentiment Non-confirmation at highs or lows

Bullish Excess Energy

Bearish Excess Energy

Each represents areas where markets show emotional imbalances that present opportunities to assess and look for high probability setups that are actionable and likely to be consequential price reactions.

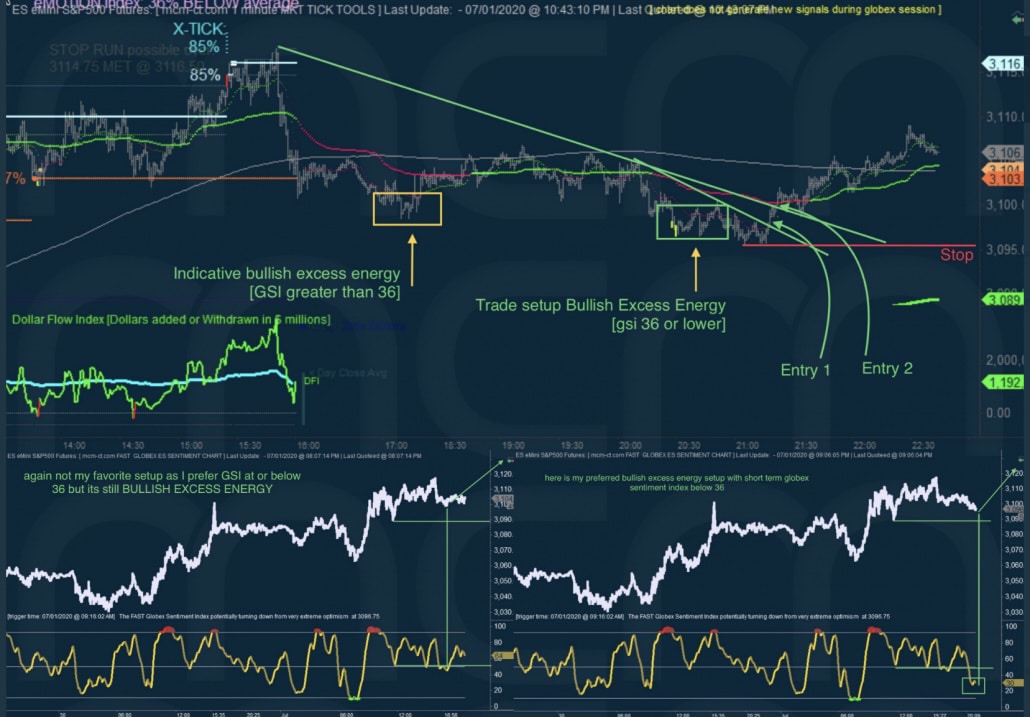

The toolset demonstrates these capabilities during the Cash, notably the Globex session, which is exceptionally useful as highly emotional influences tend to show up overnight - especially bullish ones. Bullish excess energy setups are exceptionally useful. Bullish setups are surrounding disconnections where VERY EXTREME PESSIMISM develops.

The advantage of Bullish Excess Energy is that it tells you about emotional imbalances, so you can start looking for an entry. After a bullish excess energy setup, the price jumps over the momentum line or “Danny Line,” which is often suitable for entry.

Look for Cycle Support

Seller Exhaustion

break out of Buyer Exhaustion

or any signal you can use to find a good stop.

The significance of GSI at or below 36 is that this is an emotionally stretched area where your odds significantly increase, winning or getting a successful risk manageable trade.

When you have GSI alone at or below 36, that is a lively good risk-reward area. When combined with an emotional imbalance like a lower GSI versus a higher price low - this is a MUCH HIGHER RISK to REWARD RATIO.

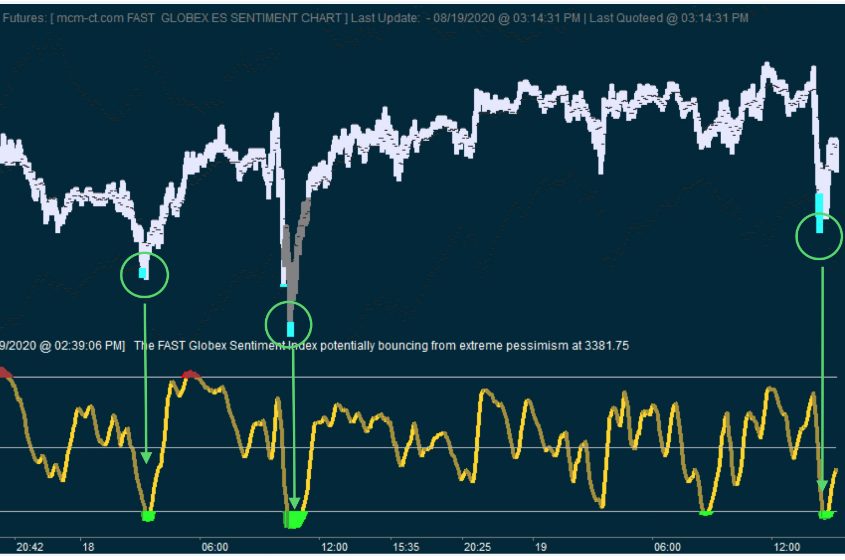

Above you can see the Fast Globex Sentiment Index which is an excellent tool for showing market participants' short-term pessimism/optimism at any given time. This can be used for trading in several ways:

- The easiest way to look at it is that showing extreme pessimism price is getting in an area where a bounce could ensue, while if it shows extreme optimism, a correction is close. However, the signals are more a warning flag for the look-out of the reactions mentioned above rather than a "hard" call. Because there are situations where price could travel a lot further in the trend's direction when at the same time, FGSI is pegged at the lower/upper boundary.

- Confirmed lows/highs - FGSI indicates the continuation of the trend when both Sentiment and price action make lower lows or higher highs.

- Unconfirmed lows/highs - FGSI indicates pause/reversal when price makes a lower low (or higher high), but Sentiment makes a higher low (or lower high). These can be extremely powerful, especially when coming after a prolonged move and showing several unconfirmed lows/highs.

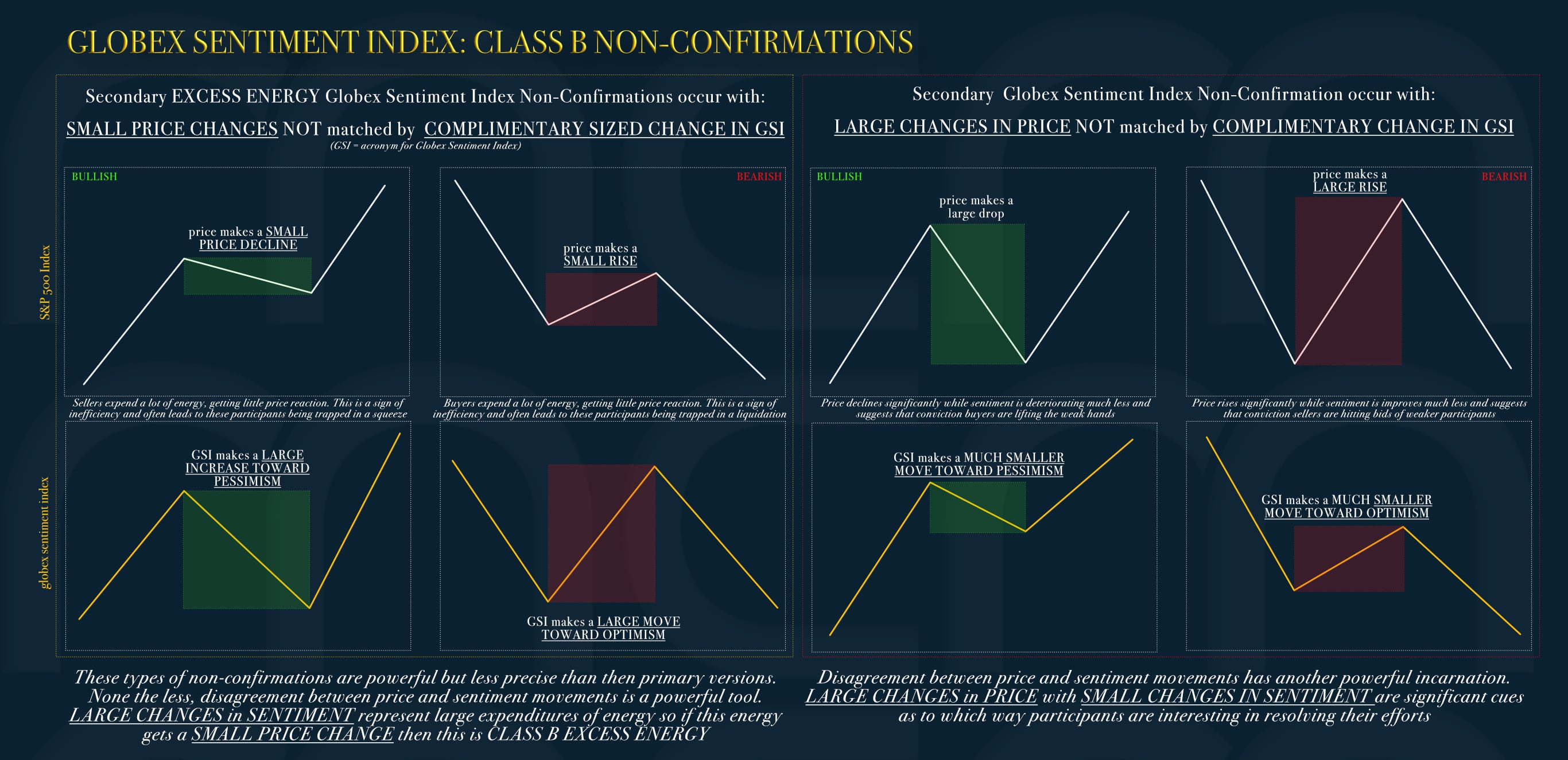

- Excess Energy set-ups - FGSI indicates buyer/seller inefficiency when Sentiment moves a lot in one direction, but the price does not. These can hold, meaning the inefficient side is likely to get rolled over or fail, leading to strong reversals (e.g., if excess energy gets broken through, this can lead to an acceleration towards that side).