Please review the information below. The contact/inquiry form for mcm-Gold is at the bottom of this page. If you’d like to inquire about our offer, check availability, request more details, or start a transaction, complete the form, and one of the mcm-Gold team will contact you. (This offer is available exclusively to current or past clients of mcm-ct.com.)

Executive Overview

Since 2023, MCM-CT has maintained a strongly bullish stance on gold, accurately predicting its trajectory toward $3,000 and projecting future values of $18,000-$20,000 by 2030. As gold approaches our initial targets, having risen 40% this year alone, we offer qualified MCM members exclusive access to physical gold at significant discounts through our established mining operations.

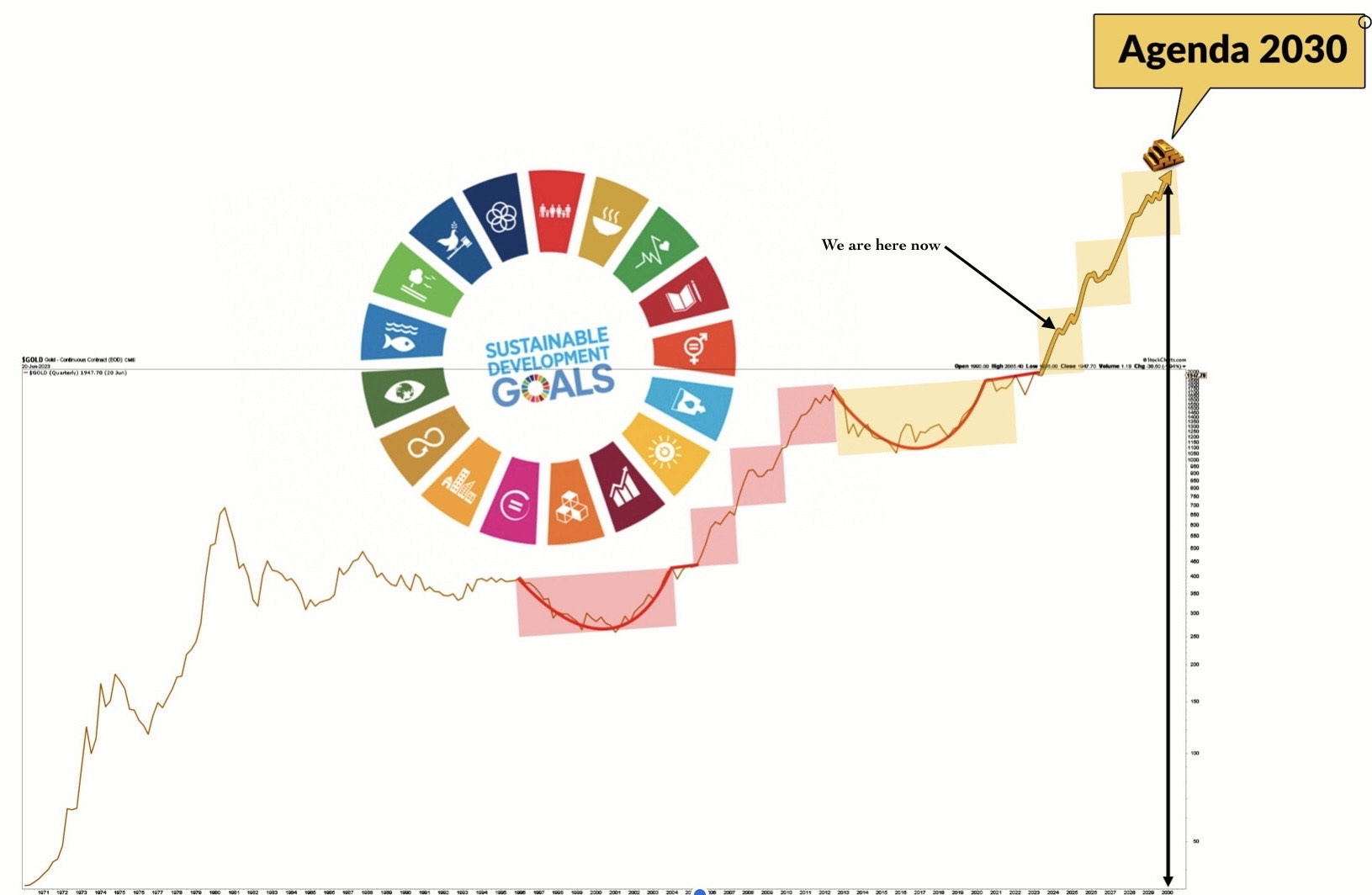

Unchanged chart from 2023

Gold still remains exceptionally cheap, and the chart below represents my analysis of this. Gold was in the 1900s, despite the move to $2800.

VALUATION/RISK CHART FROM 2023 - GOLD WAS AND REMAINS UNDERVALUED

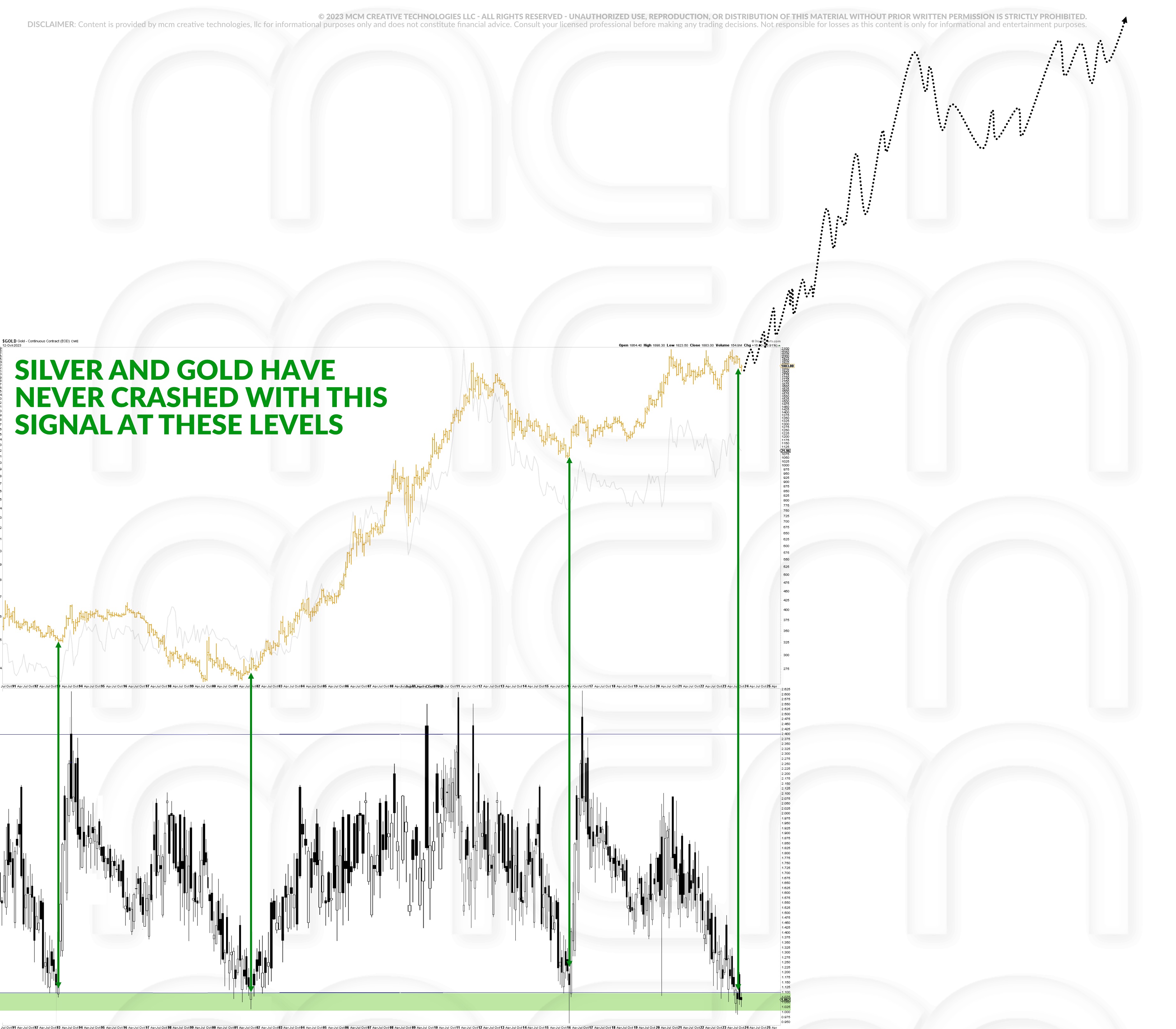

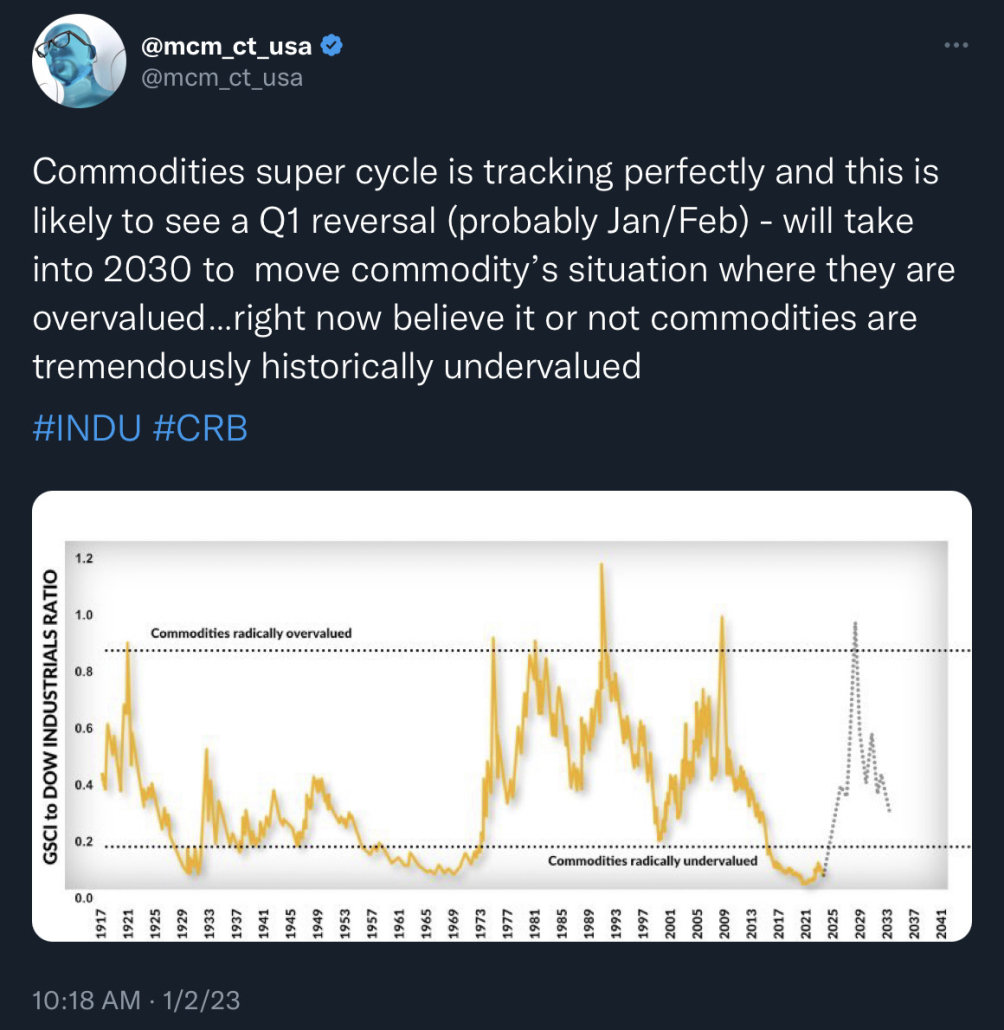

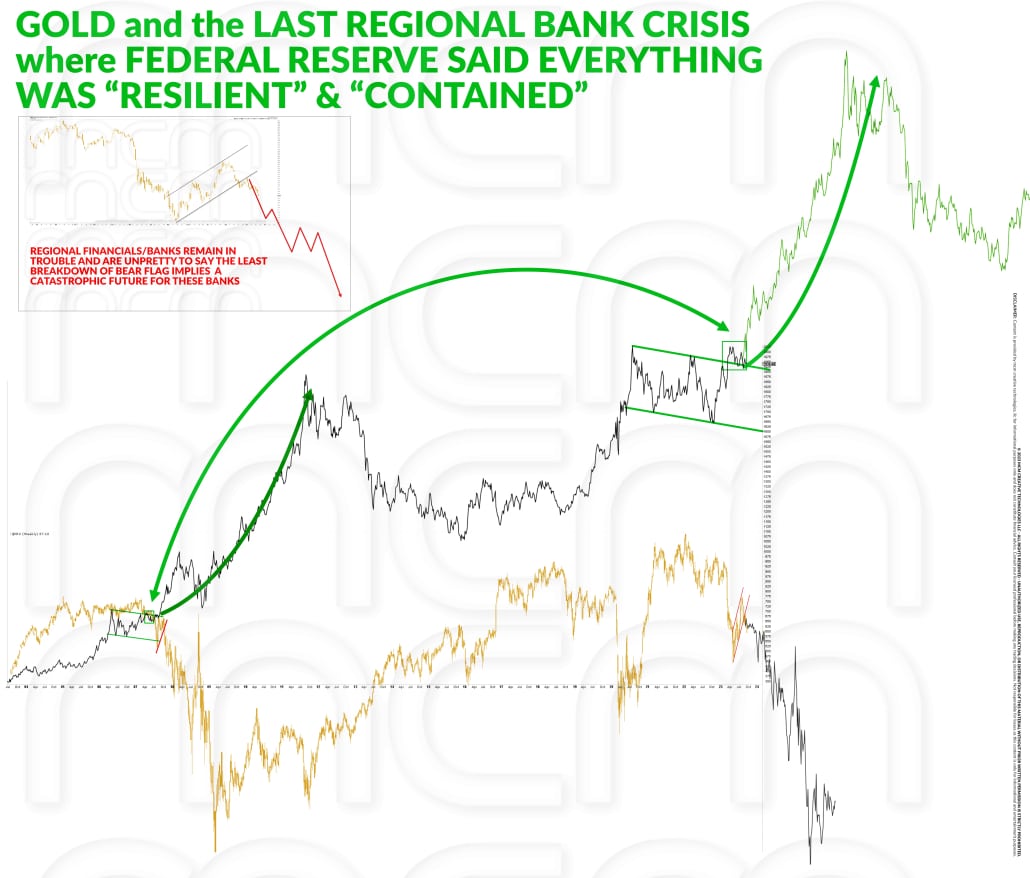

Our analysis of gold's role in the current financial landscape reveals a fundamental shift extending through 2030. Despite global inflation affecting various asset classes, gold stands uniquely positioned among commodities. While many commodities face challenges from recessionary pressures, my research indicates that gold's monetary characteristics set it apart as commercial banks, money center banks, central banks, and sovereigns increasingly recognize it as the only real money.

The current market dynamics reflect this analysis. Even as the US Dollar Index shows strength, gold continues to demonstrate remarkable resilience. This pattern confirms my view of a structural shift in how gold is valued relative to fiat currencies. My analysis points to this supercycle continuing through 2030, characterized by shallow pullbacks and sustained upward pressure - a characteristic pattern of monetary revaluation cycles.

Gold's Structural Shift:

Our analysis indicates a fundamental shift in gold's role within the global financial system:

- Commercial banks, money center banks, central banks, and sovereigns increasingly recognize gold as real money

- While many commodities remain vulnerable to economic cycles, gold's monetary role positions it uniquely

- Current market conditions suggest an impending super-cycle lasting into the 2030s

- Pullbacks are expected to be shallow, making timing-based/dip-buying trading strategies challenging

Leadership & Expertise

Peter Campbell - Founder, MCM-CT

With three decades of experience in global financial markets, Peter Campbell has worked with major Wall Street investment banks since 1993 (JP Morgan, Oppenheimer, US Bank, Piper Jaffray), developing particular expertise in trading system development, futures markets, and commodity trading. His combination of market analysis and strategic infrastructure development has beeln the driver behind unique tools and opportunities at MCM. He previously held multiple Financial Registrations, including NASD Series 3 & 7 and NFA membership.

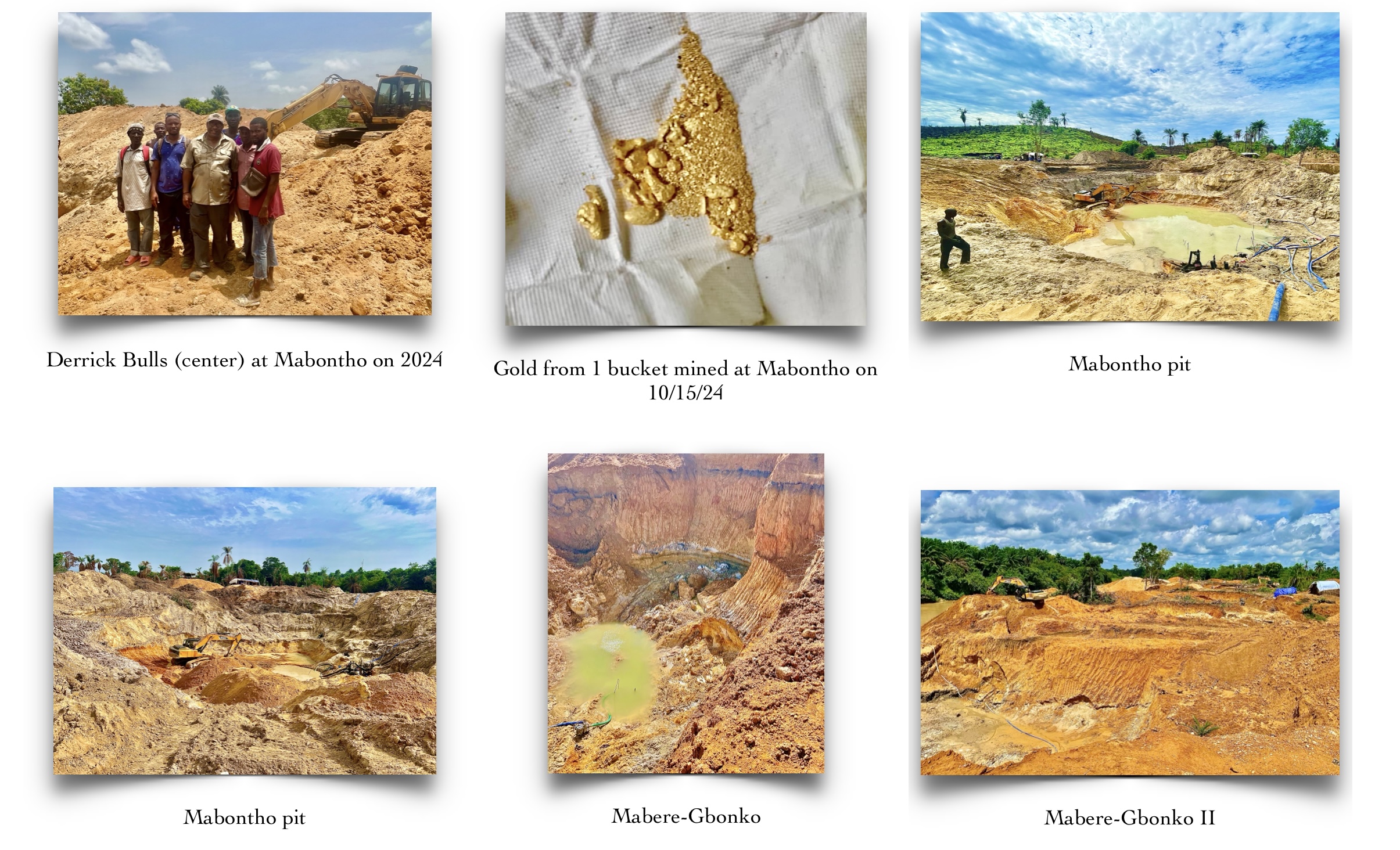

Derrick Bulls - Mining Operations Director

A transformative cross-cultural leader with over 15 years of minerals mining experience across three continents, Derrick brings extensive expertise in cross-border finance and mining operations. His background includes:

- Options trading at the Chicago Board Options Exchange and Pacific Stock Exchange

- Leadership at Pacific Capital Management

- Executive Director, Hands Helping Hands, Inc.

- Previously held multiple financial certifications, including NASD Series 3,7,29,63

- Proven track record in mining operations and logistics

Strategic Mining Operations

Current Infrastructure

We've established significant mining operations in Sierra Leone, focusing on three sites:

- Mabere-Gbonko I

- Mabere-Gbonko II

- Mabontho

Expansion

- Kabiri exploration site: Projected capacity of 1,200-2,400 kilos annually

- Additional license acquisitions under evaluation

- Ongoing operational optimization

Exclusive MCM Client Opportunity

Member Eligibility and Pricing:

- 25% discount from the Gold price lock or spot market price at the time of funds receipt for qualifying members with memberships over three months in duration before November 1, 2024 (requires reactivated Livestream or Expert Membership)

- 15% discount from the Gold price lock or spot market price at the time of funds receipt for qualifying members with initiating memberships starting after November 1, 2024

- With gold priced by purity, our 25% discount means exceptional value. For instance, with a $2800 market rate for 24-karat gold, our 22.5-karat gold is $1973 per ounce, and 23-karat gold is $2012 per ounce

All price accommodations may be changed, terminated, or limited at any time for any reason

Price Lock Structure:

-

- Price lock requires a non-refundable deposit of $250 or 0.1% of order value, whichever is greater

- Deposit locks price for 3 business days

- Upon price lock confirmation, a 70 % deposit must be paid within these 5 business days to initiate an order

Allocation Availability

-

- 40 kilos from Mabontho mine

- 40 kilos from Mabere-Gbonko I

- Potential additional 30+ kg allocation from Mabere-Gbonko II (pending evaluation)

Mutual Benefits and Value Creation

Our ability to offer significant discounts is made possible through our unique pre-production sales model:

- Pre-production sales facilitate rapid production/mining expansion

- Accelerated implementation of new mining technology

- Securing additional mining licenses

- Locking in long-term land rights and government licenses

- Creating sustainable value for both members and operations

This model enables us to offer members preferential pricing while funding expansion and technological advancement, creating a win-win scenario for all participants.

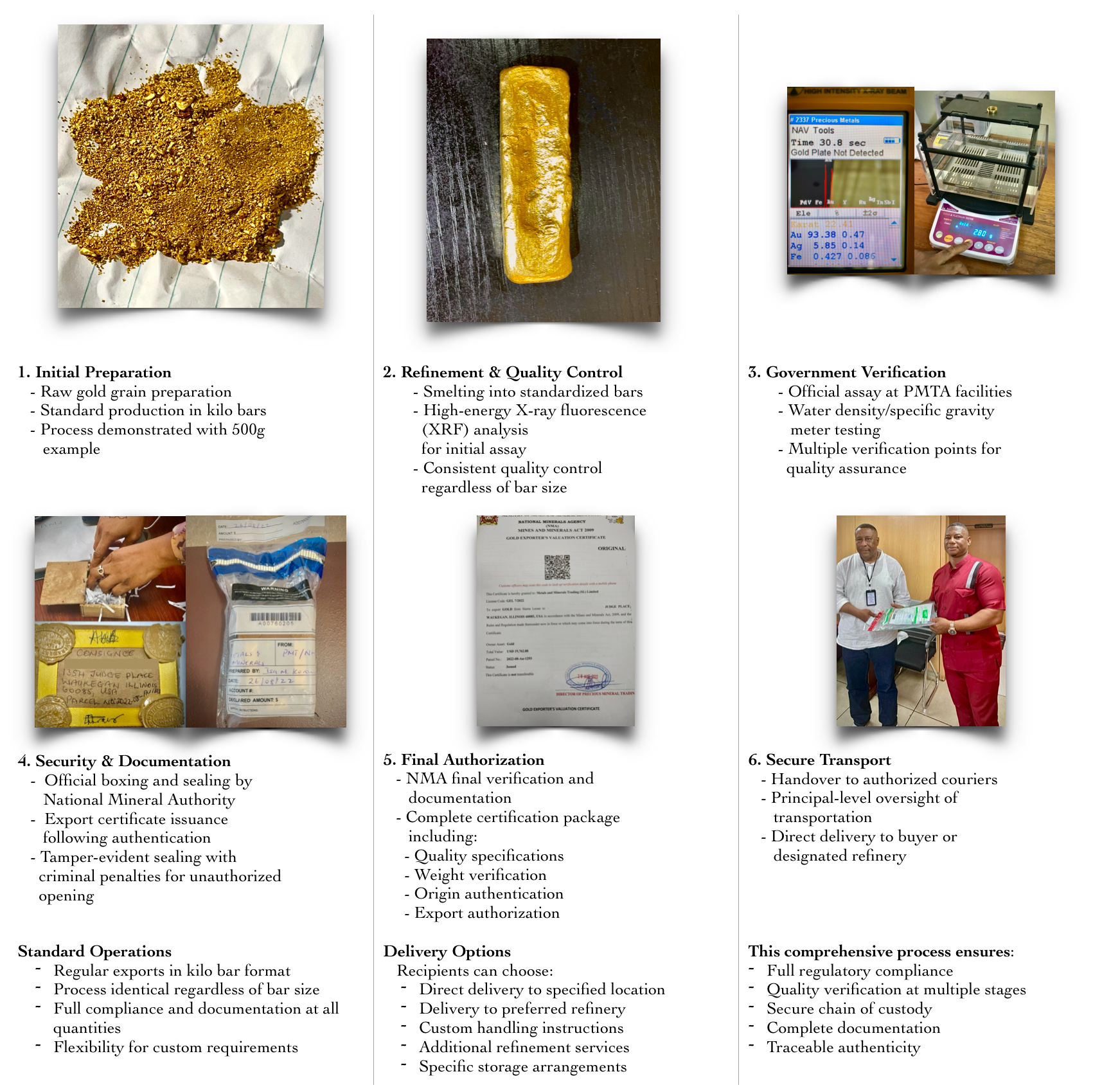

Export Process & Compliance

Our export process follows strict protocols established by Sierra Leone's National Minerals Authority:

- Quality certification

- Export documentation

- Legal compliance verification

- Secure courier delivery

- Complete chain of custody documentation

Our gold exports from Sierra Leone follow a rigorous, government-regulated process overseen by the Precious Minerals Trading Agency (PMTA) of the National Minerals Authority (NMA). While our standard export unit is the kilo bar, the below illustrated process demonstrates our proven compliance procedures.

Terms and Conditions

- 3 ounces minimum per order for USA orders (if you have special circumstances or are not in the USA please don‘t hesitate to contact us directly)

- Our transactions documents will be in grams but are easily converted to ounces and will reflect discounts from spot per troy ounce

- This offer is only in the USA or regions recognizing US law

- Price lock requires a non-refundable deposit of $250 or 0.1% of order value, whichever is greater

- Deposit locks price for 3 business days

- Upon price lock confirmation, a 70 % deposit must be paid within these 3 business days to initiate order

- 30% balance plus export costs (4 % of spot) required once Gold is available for shipping

- Delivery will be by courier to your physical location or designated refinery

- Any custom refining requests, weights, or processing are optional and will be available once at the refinery, where the refinery will estimate costs and will be available for request/purchase by you (for example, it is possible to request coins or custom mold at some refineries for a fee)

Delivery:

Standard delivery window: 60-90 days from order confirmation -

Specific delivery date provided before payment processing -

Shorter delivery times frequently achieved -

Rainy season (May through October) may extend delivery to 60-120 days due to weather impacts -

Weather-related delays will be communicated promptly with revised delivery date - Any unfulfilled production orders will be fully refunded via original payment method

Refund and Return Policy:

Cancellations after 70 % deposit will be settled at 8% discount to current spot price (our standard buyback protocol) plus 5 % cancellation fee, with client entitled to 70 % of any price appreciation if any, reflecting their funded position

Returns: Non-returnable post-delivery; exceptions for discrepancies reported within 7 business days will be settled at 8 % buyback fee plus 7 % handling/restocking fee

Final Payment: Pay balance and export fees within 3 business days of shipping notice. Non-payment forfeits deposit

To take advantage of this offer, members must agree to MCM-CT's terms of service and maintain an active membership for a year at the Individual or Institutional product.

Terms and conditions apply. Offer subject to change or termination at MCM-CT's discretion & without notice. Individual purchase limits may apply. For detailed information about licensing, regulatory compliance, and participation requirements, please contact us directly.

.

The Advantages of Importing Dore Gold to USA

- Duty-Free as a Commodity: Dore gold, classified as a raw commodity by U.S. Customs, is exempt from import duties, making it more cost-effective than refined gold.

- No Import Taxes: Treated as a primary material for further processing, dore gold avoids import taxes, reducing initial investment costs.

- Compliance Requirements: Accurate documentation on origin, weight, and purity is required.

- Cost Savings: Importing dore gold duty-free lowers costs, increasing profitability for investors when refined and sold.

- This exemption enables investors to import and process dore gold in a cost-efficient, tax-advantaged manner.

- Once imported, dore gold can be easily refined in the U.S. through reputable refiners who specialize in processing raw precious metals. Refiners often offer competitive buyback prices usually between 1% & 3% discount to spot gold prices, allowing investors the option to sell directly at market rates once the gold is purified, providing flexibility and potential for profit.

Small-scale gold mining Sector Insight:

The artisanal and small-scale gold mining sector represents a significant portion of global gold production, often with limited investment due to its challenges. However, with proper due diligence and ethical sourcing, as we've established, investment in this sector can offer:

- High Social Impact: Enhancing community benefits through employment and improved living conditions.

- Environmental Improvements: Investment can lead to better practices, reducing environmental impact.

- Attractive Returns: Given the sector's nature, investments can yield high returns, often with quicker payback than traditional mining.

Our Commitment:

We've navigated the complexities of ASGM in Sierra Leone, ensuring our operations meet stringent legal, ethical, and social standards. This venture promises financial returns and aligns with responsible investment trends, appealing to a new generation of investors seeking impact alongside profit.

Join Us in This important Gold Investment Opportunity:

This is an invitation to invest in Gold not just as a hedge but as a fundamental shift in recognizing its true value in today's financial landscape. Secure your share in this gold bull market with MCM-CT, where we transform strategic insight into tangible wealth.

MCM Gold Investment Risk Disclosure:

- Market Volatility: Gold prices can fluctuate significantly, impacting your investment's value.

- Liquidity: Selling physical gold might not be as quick as other investments and could involve additional costs.

- Economic Factors: Economic instability can unpredictably affect gold prices.

- Operational Risks: Issues related to mining, delivery, or export could affect your investment

- Storage and Insurance: Physical gold requires secure storage and insurance, which adds to the cost.

- Regulatory Changes: New laws or regulations could influence gold ownership and trade

.- Physical Asset Risks: Gold is susceptible to theft, loss, or damage.

- Currency Fluctuation: Changes in currency values can alter your investment's worth.

- No Yield: Gold does not generate income or dividends; its value is market-driven.

- Long-Term Investment: Gold may not be ideal for short-term investment goals due to price volatility.

Acknowledgement: By investing, you confirm you understand these risks. MCM-CT does not assure any performance, and past results do not predict future outcomes. It's advisable to consult with a financial advisor. This investment should be part of a broader, diversified portfolio. Always conduct thorough research before investing.

Disclaimer: This is a general risk disclosure. For detailed understanding of risk and for advice, consult with a professional. MCM-CT may modify this disclosure at any time.