mcm daily market update 18.Feb.22

ST trend: down (with potential ST bounce attempt)

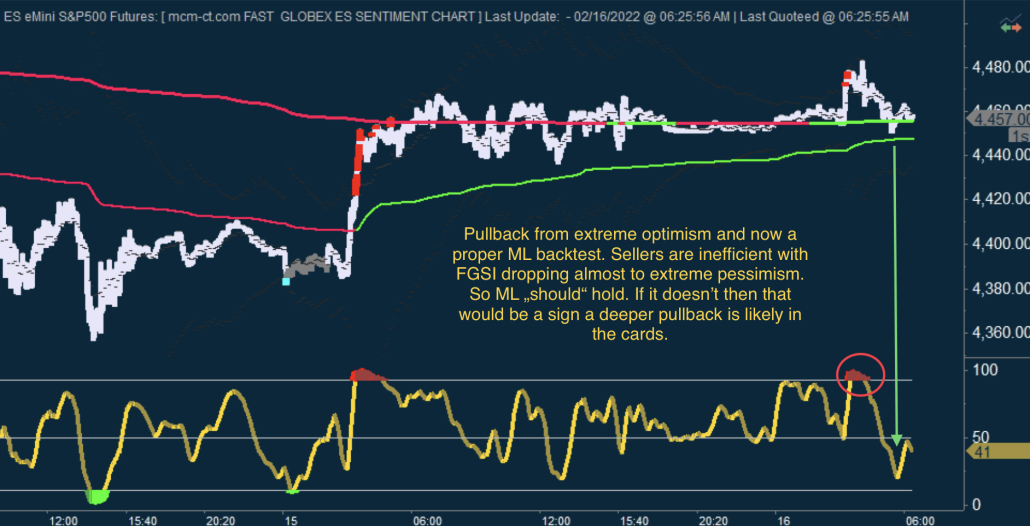

Yesterday we were noting that the ST trend was neutral as both sides were inefficient via FGSI and ML was being whipsawed in both directions. We did mention that "ML is still a key level so if one side manages to sustain a move above/below ML, that would be important to consider". The market obliged. Once ML was lost on the downside, sellers never looked back. Price grinded lower the entire RTH session with only a feeble bounce attempt late morning, which was quickly exhausted and we closed at the lows.

The o/n proved once more that closing at the lows is a trap, especially during OPEX week. We bounced from the lows right into a ML test. ML capped price with ease and the market kept making lower highs, until it finally plunged on yet another Russia headline. The biggest problem for buyers is that this decline was so large that it took out yesterday's lows (which were unconfirmed on FGSI). So while FGSI is at extreme pessimism and could trigger a near term bounce, because the lows are confirmed now, more work is likely needed before finding a bottom. Bigger picture, sellers are in control until ML is won back in a sustained way. Today is OPEX, so expect whipsaws in both directions. Due to the large drop from yesterday, market makers might be incentivised to push this higher, just something to be aware of.