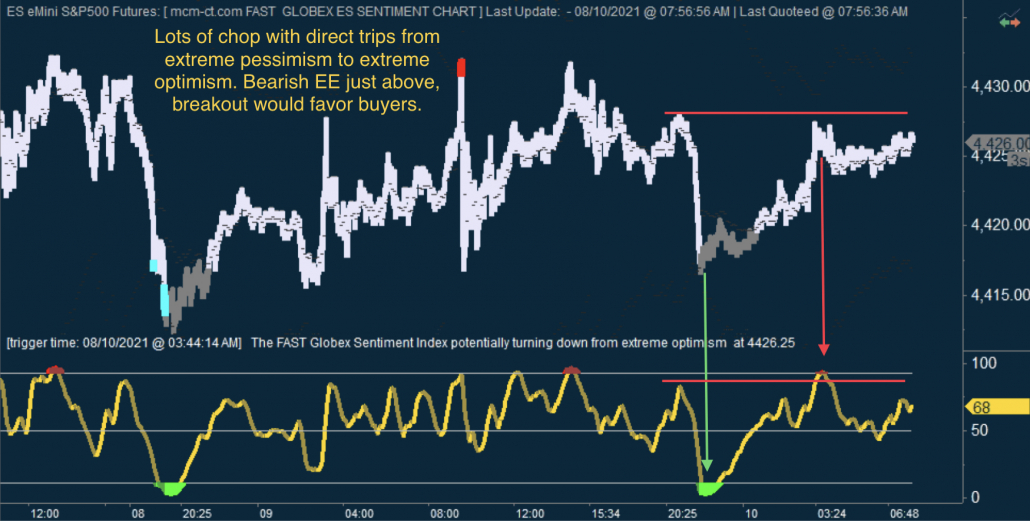

mcm daily market update 10.Aug.21

ST trend: neutral

Yesterday we were mentioning that the ST trend is neutral, as both sides were inefficient via FGSI. Since then we had spikes higher and lower, but price went basically nowhere. Yesterday's cash session did finish higher vs Sunday's o/n, so up grind is still holding.

The o/n brough the "usual" vertical price drop which pushed FGSI to extreme pessimism, where buyers stepped in. Price went then back to where it used to be. In conclusion, it seems to be "steady as she goes" as price keeps grinding higher with the ocasional steep drop. ML is still below price and being defended, so until sellers can break below and sustain a breakdown the ST trend is up.